- What Is a Bonding Curve in Crypto?

- Why Are Bonding Curves So Popular for Pump.fun Tokens?

- How Pump.fun Works: A Step-by-Step Example

- Risks and Rewards of Bonding Curve Launches

- Swap ETH or SOL to Join the Next Meme Coin Launch

- Final Thoughts: Are Bonding Curves the Future of Meme Coins?

- Frequently Asked Questions (FAQ)

In 2025, nothing has captivated crypto Twitter quite like Pump.fun. Overnight, random meme coins are skyrocketing from zero to millions in market value—all driven by a simple yet powerful mechanism: the bonding curve. If you’ve watched a coin go 100x in minutes and thought, “I wish I got in earlier,” you’re not alone.

Bonding curves reward the earliest buyers, automatically increasing prices with each new trade. That’s why the first wave of investors often sees life-changing returns, while latecomers risk becoming exit liquidity. But here’s the warning: while bonding curves make launches fun, fast, and viral, they also carry serious risks. Most meme coins fade out after the initial hype, and unless you understand how the economics work, you could lose your SOL or ETH just as quickly as you bought in.

In this article, we’ll explain what bonding curves are, how Pump.fun uses them, the risks involved, and—most importantly—how to prepare by holding the right assets. With Flashift, you can swap ETH or SOL instantly, ensuring you never miss the next viral meme launch.

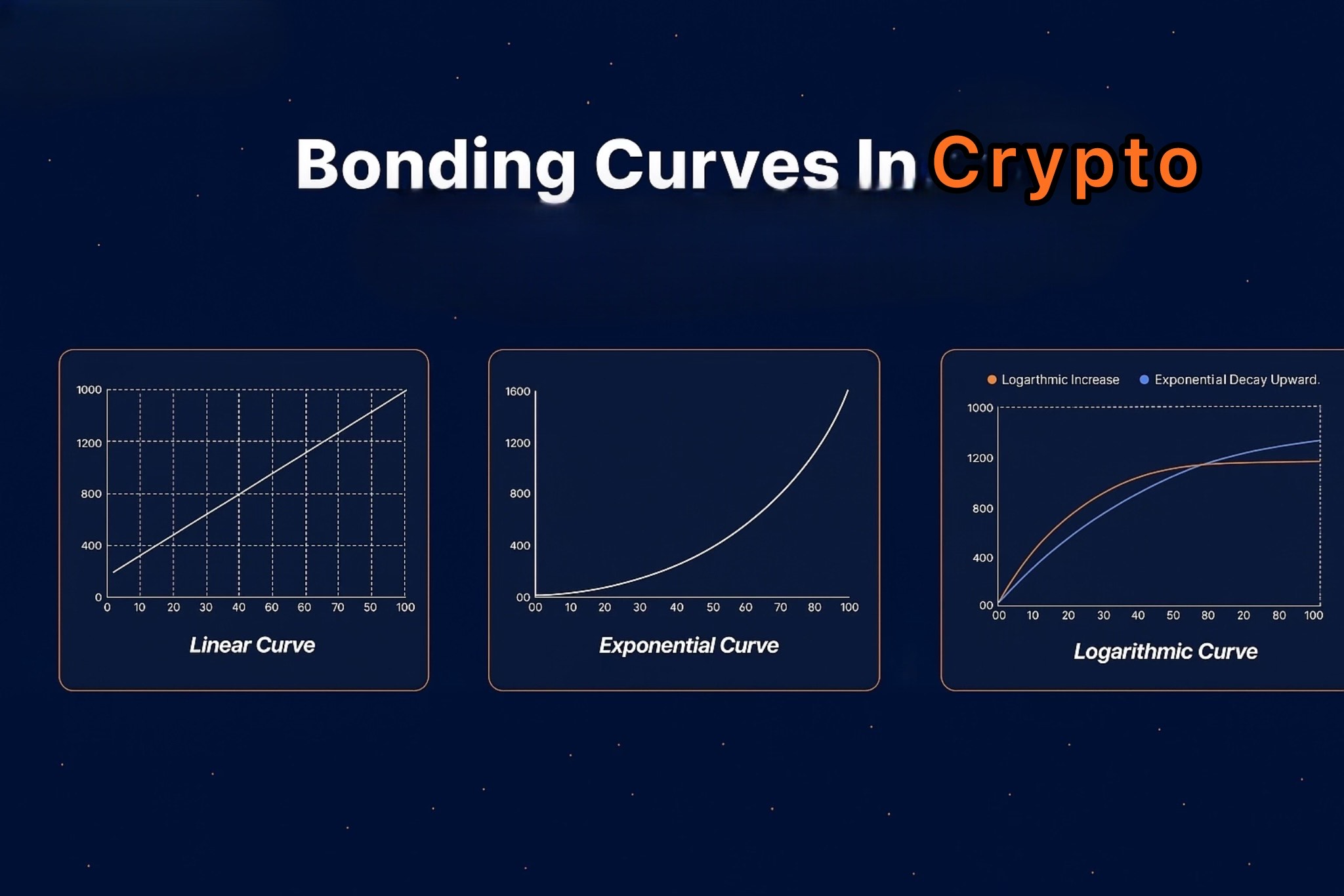

What Is a Bonding Curve in Crypto?

At its core, a bonding curve is a pricing model: the more tokens people buy, the higher the price automatically becomes. Instead of depending on an exchange order book, the price is determined by a mathematical formula.

At its core, a bonding curve is a pricing model: the more tokens people buy, the higher the price automatically becomes. Instead of depending on an exchange order book, the price is determined by a mathematical formula.

Think of it like a rollercoaster track: it starts flat (cheap), then curves upward as demand increases. Early buyers get in at the bottom, while each new purchase pushes the token higher along the curve.

The Simple Economics of Price Rising with Demand

- Mathematics in action: A bonding curve is usually defined by a function like P = k × Q, where price (P) increases as quantity (Q) of tokens sold rises.

- Early entry advantage: The first buyers get tokens at the lowest possible price. As more buyers join, the cost for new entrants rises exponentially.

- Automatic market making: Unlike traditional exchanges, there’s no need for matching buyers and sellers—the smart contract itself provides liquidity and sets the price.

This creates a self-fulfilling cycle: hype drives buying, buying pushes up price, and rising prices fuel more hype.

How Bonding Curves Power Meme Coin Launches

Platforms like Pump.fun use bonding curves to make launching a meme token seamless:

- A creator deploys a token linked to a bonding curve.

- Buyers purchase directly from the contract, automatically increasing the price.

- Once enough tokens are sold, liquidity is usually migrated to a DEX like Raydium (on Solana).

This system makes meme launches viral, fair, and fast—anyone can join instantly, without waiting for centralized exchange listings.

Why Are Bonding Curves So Popular for Pump.fun Tokens?

Bonding curves aren’t just math—they’re the fuel behind the viral energy of Pump.fun. By lowering barriers for creators and making price discovery automatic, they’ve turned meme coin launches into the fastest-moving trend of 2025.

Lower Barriers to Entry for New Creators

Traditionally, launching a token required complex coding, liquidity pools, and exchange listings. With bonding curves, all of that is automated:

- Anyone can launch a meme coin in minutes.

- The curve itself provides the liquidity.

- Creators don’t need big budgets or technical expertise.

This democratization of token launches explains why hundreds of new Pump.fun coins are appearing daily.

Built-In Price Discovery Without Exchanges

Normally, traders rely on markets to find the “right” price of a token. With bonding curves:

- The smart contract sets the price as supply increases.

- There’s no need for centralized exchanges or market makers.

- Early momentum automatically drives the market forward.

This makes meme coins accessible to retail traders worldwide, not just insiders with early exchange listings.

Viral Appeal for Meme Traders

Bonding curves add a gamified element to meme trading:

- Everyone knows the earlier you buy, the cheaper your entry.

- Each new purchase visibly raises the price, creating instant FOMO.

- The curve design rewards speed, hype, and community participation.

On platforms like Pump.fun, this creates a lottery-like excitement: every new token feels like a race to get in before the crowd.

Read More: How to Spot the Next Viral Meme-Coin on Pump.fun Safely

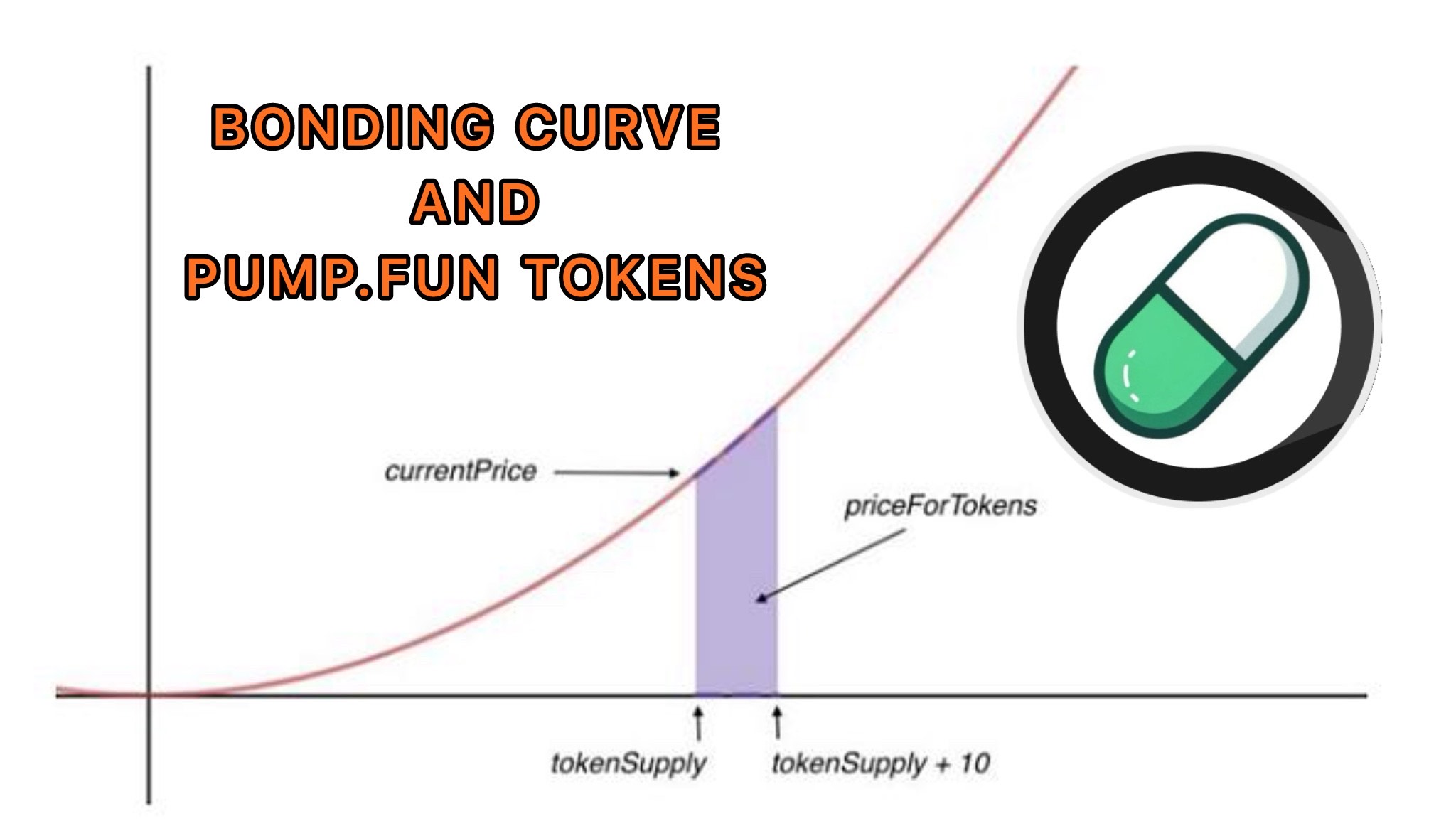

How Pump.fun Works: A Step-by-Step Example

Pump.fun has become the poster child for bonding-curve launches, especially on Solana, where transactions are lightning fast and cheap. Here’s how it typically plays out when a new meme coin goes live:

- A creator deploys a new meme token on Pump.fun.

- The token is automatically linked to a bonding curve smart contract.

- Early buyers can purchase tokens directly from the curve at the lowest possible price.

- Each new buy pushes the token higher up the curve, raising the entry price for the next buyer.

How Early Buyers Benefit the Most

The economics of the curve means:

- First movers win. The first handful of buyers get tokens at fractions of a cent.

- As the hype spreads on Twitter, Telegram, or Discord, more users pile in—pushing the price up rapidly.

- Many meme tokens on Pump.fun have gone from $1,000 market cap to $1M+ in hours, purely through bonding-curve mechanics.

It’s a lottery-style system where speed and timing matter more than fundamentals.

Transition from Curve to Liquidity Pool

Once a certain amount of tokens are sold (often reaching a threshold in SOL or USDC), the smart contract:

- Automatically creates a liquidity pool on a DEX like Raydium.

- Migrates liquidity from the bonding curve into the pool.

- Allows open trading between the meme coin and SOL/USDC like any other token.

This is the “graduation point” for a Pump.fun token: from a bonding-curve experiment into a tradeable market asset.

Read More: Pump.fun: The Solana Meme-Coin Launchpad Everyone’s Talking About

Risks and Rewards of Bonding Curve Launches

Bonding curves give meme coins their explosive upside—but they also come with serious risks. Understanding both sides of the curve is essential before you swap into the next Pump.fun token.

The High Risk of Pump-and-Dump Cycles

- Meme tokens on bonding curves often rise fast, but they can also collapse just as quickly.

- Creators or early whales may sell into the hype, leaving late buyers as exit liquidity.

- Many tokens see 90%+ drawdowns within days of launching.

This is why it’s crucial to only invest what you can afford to lose.

Why Most Meme Tokens Go to Zero

- The majority of Pump.fun launches are purely speculative—no utility, no roadmap, no lasting community.

- Once the initial excitement fades, liquidity dries up and the token price flatlines.

- Historical data shows that while a few tokens go viral, most meme launches don’t survive beyond the first week.

How to Spot Safer or More Sustainable Launches

Not all bonding-curve tokens are doomed. Some do evolve into strong communities with lasting value. Look for:

- Locked Liquidity: Ensures the token can’t be rug-pulled immediately.

- Active Communities: Meme coins live or die by hype—check Twitter, Telegram, Discord activity.

- Creator Transparency: While most are anonymous, visible teams or creators add a layer of trust.

Swap ETH or SOL to Join the Next Meme Coin Launch

If you want to catch the next Pump.fun meme token before it moons, you need to be prepared. That means having the right assets on the right chain—most commonly SOL for Solana launches or ETH for cross-chain meme plays. Without them, you’ll miss the early entries that bonding curves reward.

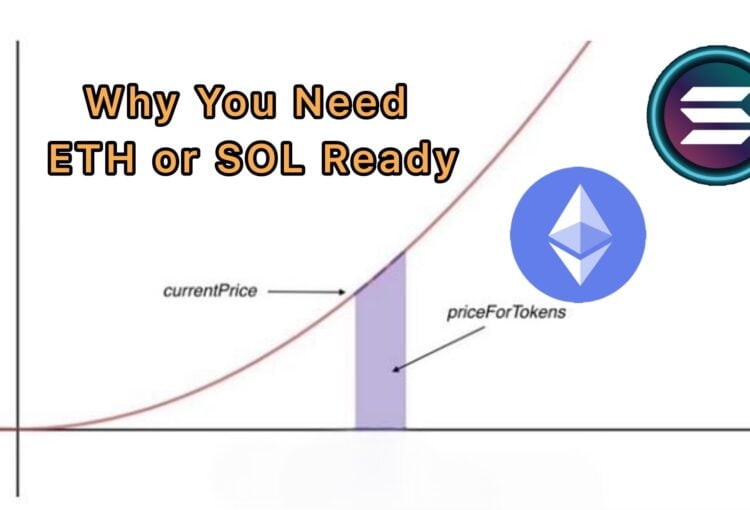

Why You Need ETH or SOL Ready Before Launch

- Pump.fun on Solana: The majority of bonding-curve launches run on Solana because of its low fees and fast confirmations. You’ll need SOL in your wallet to buy in.

- Ethereum & Other Chains: Some meme tokens launch on Ethereum or are bridged across multiple chains. Having ETH on hand ensures you don’t get stuck waiting while others jump in.

- Speed Matters: By the time you move funds from an exchange or bridge, the price curve may already be climbing.

Being prepared is the difference between getting in early or buying at the peak.

Exchange USDTERC20 to ETH in one second with Flashift.

How Flashift Helps You Swap Instantly Across Chains

At Flashift, we make it easy to be launch-ready:

- Swap into SOL or ETH instantly from any major token.

- Multi-chain support—Ethereum, BNB Chain, Polygon, Arbitrum, Avalanche, and more.

- Non-custodial swaps—you keep full control of your wallet at every step.

- No KYC delays—privacy-first trading that’s as fast as the memes you’re chasing.

Swap ETH/SOL Privately and Securely With Flashift

Don’t let slow bridges or exchange transfers make you late to the party. With Flashift:

- Select your token and swap into ETH or SOL.

- Be ready to ape into the next Pump.fun launch before the curve explodes.

Swap ETH or SOL now with Flashift and never miss the next Pump.fun meme launch.

Try exchanging BTC to SOL in one second.

Final Thoughts: Are Bonding Curves the Future of Meme Coins?

Bonding curves have completely changed how meme tokens launch. Platforms like Pump.fun prove that a simple curve can fuel viral growth, reward early buyers, and gamify the trading experience. But they also highlight the risks—most tokens crash as fast as they rise, and late entrants often get burned.

For traders, the lesson is clear: if you want to play the bonding-curve game, you need to be early, prepared, and cautious. That means holding SOL or ETH ready to deploy, understanding the risks, and using safe, non-custodial tools to move fast.

At Flashift, we give you that edge. With our multi-chain swap, you can instantly swap into SOL or ETH from any token—without KYC, without custody risk, and without the delays of traditional bridges.

Bonding curves may power the trend, but preparation powers success. Swap ETH or SOL now with Flashift and join the next Pump.fun launch →

Frequently Asked Questions (FAQ)

How does Pump.fun use bonding curves?

Pump.fun lets anyone launch a meme token on Solana instantly. The bonding curve contract handles all sales, pushing up the price as demand grows. Once a threshold is reached, liquidity is added to a DEX like Raydium for open trading.

Why are meme coins so tied to bonding curves?

Bonding curves make meme launches simple, fast, and viral. They lower entry barriers, create built-in price discovery, and fuel FOMO—perfect for the meme culture driving crypto in 2025.

What are the risks of bonding curve launches?

-

- Lack of fundamentals: most tokens don’t survive beyond the hype.

- Liquidity risks: if liquidity isn’t locked, rugs are possible.

Always treat meme launches as high-risk speculation.

How can I join a Pump.fun meme coin launch?

You’ll need SOL in your wallet (for Solana launches) or ETH for Ethereum-based meme plays. Buy in directly through the bonding curve contract on Pump.fun or other launchpads.

What’s the fastest way to get SOL or ETH for meme launches?

With Flashift’s multi-chain swap, you can instantly convert USDT, USDC, or other tokens into SOL or ETH—without KYC or custody risk. This ensures you’re launch-ready when the next meme coin starts trending.

Swap ETH or SOL now with Flashift