- Top PAXG DeFi Yield Opportunities (2026 Snapshot) 📊

- Why PAXG Is a Perfect Fit for DeFi Protocols

- Top DeFi Strategies to Earn with PAXG

- Risk Management: How to Safely Earn Passive Income with PAXG

- How Flashift Helps You Swap and Manage PAXG Securely

- Final Verdict: The “Productive Gold” Thesis in 2026 🏆

- FAQs:

PAX Gold (PAXG) | Physical gold sits in a vault and collects dust. Tokenized gold sits in a protocol and collects interest.

It is 2026. The narrative for Real World Assets (RWA) has evolved. It is no longer enough to just hold PAX Gold (PAXG) as a hedge against inflation; smart money is using it as productive collateral to generate passive income.

But here is the confusion: Since PAXG represents physical bars on the Ethereum blockchain, you cannot “stake” it like Solana. Instead, you earn yield through Lending Markets and Liquidity Mining.

In this guide, we cut through the noise to rank the top DeFi platforms for PAXG yield in 2026. From high-APY liquidity pools on Curve to leveraged lending on Aave, here is how to make your gold work as hard as you do—and how to acquire it instantly via Flashift.

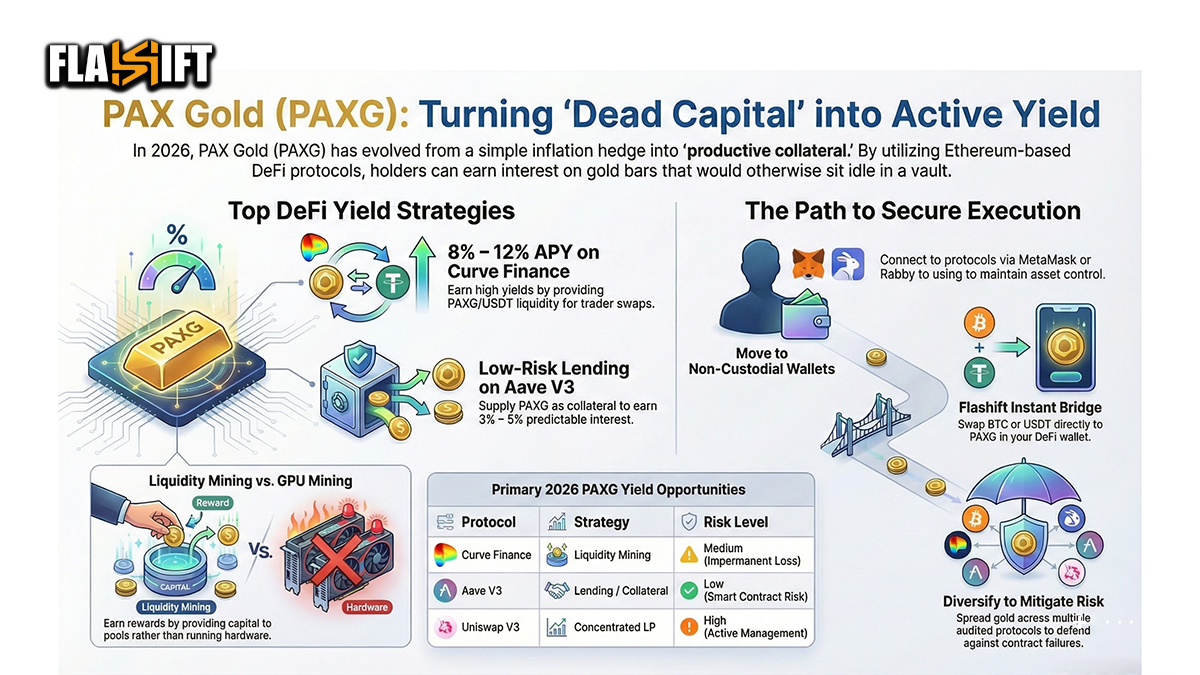

Top PAXG DeFi Yield Opportunities (2026 Snapshot) 📊

| Protocol | Strategy | Type | Est. APY | Risk Level |

| Curve Finance | PAXG/USDT Pool | Liquidity Mining | 8% – 12% | Medium (Impermanent Loss) |

| Aave V3 | Supply Collateral | Lending | 3% – 5% | Low (Smart Contract Risk) |

| Uniswap V3 | Concentrated LP | Trading Fees | Variable | High (Active Management) |

| Balancer | Multi-Token Pool | Balanced LP | 5% – 7% | Medium |

💡 Flashift Tip: To access these pools, you must hold PAXG in your own wallet. Swap USDT for PAXG instantly on Flashift to skip exchange withdrawal holds.

Can You Mine PAX Gold? (Liquidity Mining Explained) ⛏️

A common question we see in 2026 is: “How do I start PAXG mining?”

It is important to clarify the terminology. Since PAX Gold (PAXG) runs on the Ethereum blockchain and represents physical gold bars, you cannot “mine” it with a GPU like Bitcoin. However, you can participate in Liquidity Mining.

Liquidity Mining is the DeFi equivalent of digital gold mining. Instead of buying hardware, you provide capital.

How it works on Curve Finance:

-

Deposit: You deposit a pair of assets (e.g., PAXG + USDT) into a liquidity pool.

-

Earn Fees: Every time a trader swaps between Gold and USDT, you earn a cut of the transaction fee.

-

Mining Rewards: On top of fees, the protocol rewards you with governance tokens (like CRV).

This is currently the most popular way to “mine” yield from your gold holdings. It turns a static commodity into a cash-flowing asset.

⚠️ Risk Note: Be aware of Impermanent Loss. If the price of Gold skyrockets relative to USDT, you might end up with more USDT and less Gold than you started with. This is the cost of doing business in liquidity pools.

Why PAXG Is a Perfect Fit for DeFi Protocols

Most traditional assets aren’t built for DeFi, but PAXG is the exception. It bridges two worlds: the enduring value of gold and the limitless composability of decentralized finance.

At its core, DeFi thrives on liquidity, transparency, and interoperability. And that’s exactly where PAXG shines. As an Ethereum-based ERC-20 token, PAXG can be integrated into a wide range of smart contracts, enabling everything from yield farming and staking to lending and liquidity provision, all while maintaining its intrinsic value as real gold.

Here’s why PAXG is tailor-made for the DeFi ecosystem:

- Hard-Backed Value: Every token is backed by physical gold, offering a rare level of trust in a decentralized environment.

- On-Chain Flexibility: Unlike ETFs or physical assets, PAXG can plug into DeFi apps, protocols, and smart contracts effortlessly.

- Stable Yet Productive: It holds its value like gold but behaves like a crypto asset, which means you can earn yield without high volatility.

- Programmable Gold: Developers and platforms can build directly on top of it, enabling innovative financial tools backed by gold.

For investors, this means one thing: you no longer need to choose between safety and yield. With PAXG in DeFi, you get both. Whether it’s staking in a lending pool or providing liquidity in a stable-asset pair, PAXG brings gold’s timeless appeal to DeFi’s modern opportunities.

Read More: How to Buy PAX Gold (PAXG) Anonymously

Top DeFi Strategies to Earn with PAXG

PAXG isn’t just a digital representation of gold, it’s a yield-generating tool when used within the right DeFi ecosystem. In 2025, decentralized finance platforms are more robust and user-friendly than ever, offering multiple ways to put your tokenized gold to work.

Here are the top strategies smart investors are using to earn passive income with PAXG:

Staking PAXG on Decentralized Lending Platforms

Platforms like Aave, Compound, and Spark allow users to stake assets like PAXG in lending pools. When you deposit PAXG, you’re essentially providing liquidity to borrowers in return for interest, all governed by smart contracts.

- Benefit: Earn a predictable yield while maintaining exposure to gold

- Risk: Platform and smart contract risks, so always use audited protocols

Providing PAXG as Liquidity on AMMs (like Curve or Balancer)

Automated Market Makers (AMMs) like Curve Finance and Balancer support gold-backed pools where users can deposit PAXG alongside stablecoins (like USDC or DAI). You earn trading fees and incentives from every swap that occurs in your pool.

- Benefit: High APY from fees and protocol incentives

- Risk: Potential impermanent loss, but minimal when paired with low-volatility assets

Earning Yield through Tokenized Gold Vaults

Some DeFi platforms have built specialized tokenized gold vaults, where PAXG holders can deposit tokens and earn yield through actively managed strategies. These vaults often reinvest fees, optimize returns, and auto-compound earnings.

- Benefit: Hands-off strategy with optimized returns

- Risk: Higher reliance on the strategy manager or protocol mechanics

Lending PAXG for Interest (CeDeFi Options)

If you prefer a more conservative approach, CeDeFi (Centralized-DeFi) platforms like Nexo, YouHodler, or Binance Earn offer lending programs where you can lend your PAXG to vetted borrowers in exchange for a fixed interest rate.

- Benefit: Fixed income, often higher than bank savings, with lower technical barriers

- Risk: Counterparty risk, ensure the platform is licensed and insured

Pro Tip: Before choosing any strategy, assess your risk tolerance, understand the lock-up period, and use hardware wallets or smart contract audits where possible to stay protected.

The Most Efficient Route to DeFi: Flashift ⚡

To participate in Curve pools or Aave lending, you must hold PAXG in a non-custodial wallet (like MetaMask, Rabby, or Ledger). You cannot connect a Binance or Coinbase account directly to these protocols.

This is where the “entry friction” happens. Moving funds from a CEX to a wallet often incurs withdrawal fees, holding periods, and network gas costs.

The Flashift Solution:

Flashift acts as the instant bridge between your current assets and your DeFi wallet.

-

No Sign-Up: You don’t need to create an account or pass KYC to swap.

-

Direct Settlement: When you swap USDT (TRC20) or BTC for PAXG on Flashift, the gold tokens are sent directly to your DeFi wallet address.

-

Best Rate AI: Our aggregator scans many exchanges to ensure you get the maximum amount of PAXG for your deposit, giving you a head start on your yield farming.

Risk Management: How to Safely Earn Passive Income with PAXG

While the idea of earning passive income on digital gold is attractive, smart investors know that yield without risk doesn’t exist, especially in DeFi. The good news? With proper planning and risk controls, you can enjoy the rewards of PAXG-based strategies while minimizing exposure to the downsides.

Here are key principles to follow when managing risk with PAXG in DeFi:

Understand the Platform You Use

Not all DeFi protocols are created equal. Before depositing your PAXG, thoroughly vet the platform:

- Is it audited?

- Who are the developers behind it?

- What is the total value locked?

- How long has it been live?

Use Non-Custodial Wallets and Hardware Devices

If you’re interacting with DeFi directly, always use a secure, non-custodial wallet like MetaMask or Rabby. For larger sums, consider a hardware wallet to protect your private keys from phishing or malware attacks.

Diversify Your Strategy

Don’t put all your digital gold in one basket. Spread your PAXG across multiple protocols or strategies, for example, stake some in a lending pool, while placing the rest in a low-volatility AMM pair. Diversification is your first line of defense against protocol failure or impermanent loss.

Monitor Smart Contract Risk

DeFi runs on code, and even the best-written smart contracts can have bugs or vulnerabilities. Regularly review protocol updates, community audits, or bug bounty disclosures. Avoid unaudited projects promising “too good to be true” returns.

Stay Informed About Market Conditions

Although PAXG itself is relatively stable (since it mirrors gold), DeFi markets are dynamic. Factors like Ethereum gas fees, protocol APY fluctuations, and market-wide liquidity crunches can impact your earnings or exit options. Set alerts or use dashboards like DeFiLlama or Zapper to stay updated.

In short, PAXG offers one of the safest entries into DeFi, but the safety lies in how you manage the strategy. Think of it as putting a gold bar into a digital vault, you still need to choose the vault wisely, lock it correctly, and check in regularly.

How Flashift Helps You Swap and Manage PAXG Securely

At Flashift, we understand that navigating the world of tokenized assets can be intimidating, especially when you’re dealing with something as valuable as gold. That’s why we’ve built a platform that makes swapping, storing, and managing PAX Gold (PAXG) as seamless and secure as possible.

Here’s how Flashift stands out when it comes to PAXG:

Whether you’re converting PAXG to USDT, ETH, or another stable asset, Flashift enables lightning-fast swaps with competitive rates and minimal slippage. Our liquidity infrastructure is designed to handle high-value trades without delay, perfect for gold-backed tokens.

In other words, Flashift is more than just an exchange, it’s an AI-powered aggregator built for smarter, faster, and safer PAXG trading.

- AI-Powered Swap Engine: Instantly find the best rates across 100+ blockchains and a world of assets. Our AI evaluates trade speed, KYC simplicity, and trust to deliver the most optimized swap every time.

- Non-Custodial & User-First: No accounts, no custody, no hidden fees. You stay in full control of your PAXG, with fast cross-chain swaps typically completed in under three minutes.

- Developer-Friendly API: Integrate intelligent swap routing into your dApp or wallet with our robust API.

With Flashift, managing PAXG becomes seamless, secure, and personalized, powered by real-time intelligence and built on trust.

Final Verdict: The “Productive Gold” Thesis in 2026 🏆

In a 2026 landscape defined by CBDC rollouts and persistent inflation, PAX Gold (PAXG) has evolved beyond a safety net. It is now a financial weapon.

The days of letting gold sit idle in a vault are over. The modern portfolio demands productivity. By combining the sovereign immutability of physical gold with the yield-bearing mechanics of DeFi, you aren’t just hedging against the dollar—you are earning a salary on your savings.

Whether you choose the high-yield route of Liquidity Mining on Curve or the leveraged strategy on Aave, the opportunity cost of doing nothing is now too high to ignore.

The Golden Rule for 2026:

Understand the smart contract risks, manage your leverage responsibly, and never compromise on custody.

If you are ready to upgrade your portfolio from “Dead Capital” to “Active Yield,” the infrastructure is ready for you. No waiting periods. No bank approvals. Just pure, on-chain execution.

FAQs:

- Is PAXG actually backed by real gold?

Yes. Each PAXG token is backed 1:1 by one fine troy ounce of gold stored in professional vaults in London, managed by Brink’s. Paxos, the issuer, is regulated by the New York State Department of Financial Services (NYDFS) and provides monthly attestations from top auditors.

- Can I redeem PAXG for physical gold?

Yes, but typically for large quantities. Paxos allows redemption for physical gold bars, though minimum amounts and identity verification are required. For smaller amounts, you can always convert PAXG into other assets like stablecoins using Flashift.

- Is it safe to use PAXG in DeFi protocols?

Using PAXG in DeFi can be safe if you follow best practices: choose reputable, audited platforms; use secure wallets; and understand smart contract risks. The asset itself is stable, the risk lies in how you use it.

- How much can I earn by staking or lending PAXG?

Yields vary by platform and market conditions. On average, staking or lending PAXG through DeFi or CeDeFi platforms may offer 3%–8% APY, depending on demand and liquidity incentives. Always compare options before locking in your tokens.

- What are the main risks of earning with PAXG in DeFi?

- Smart contract vulnerabilities

- Impermanent loss (if providing liquidity)

- Platform insolvency (in CeDeFi)

- Regulatory changes

Mitigating these risks involves research, diversification, and using secure wallets.

- Can I use Flashift to buy PAXG directly?

Yes. Flashift allows you to buy, sell, and swap PAXG instantly, with low fees and fast execution. You can trade PAXG against popular assets like USDT, ETH, or BTC, and withdraw directly to your wallet for DeFi use.

- Why should I choose PAXG over stablecoins or Bitcoin for passive income?

PAXG offers the stability of gold without the volatility of crypto markets. While stablecoins are pegged to fiat and Bitcoin is highly speculative, PAXG lets you earn yield on an asset with intrinsic, time-tested value, making it ideal for conservative DeFi investors.