- Understanding Slippage in Cryptocurrency Markets

- Key Factors Contributing to Slippage

- How Slippage Affects Traders

- Strategies to Minimize Slippage in Crypto Trading

- How Flashift Helps You Trade with Minimal Slippage

- Final Thoughts on Managing Slippage in Crypto

- FAQs

- What is slippage in crypto trading?

- Why does slippage occur in cryptocurrency markets?

- What is slippage tolerance, and how does it work?

- How can I minimize slippage in my trades?

- What is the difference between positive and negative slippage?

- Are certain trading strategies more susceptible to slippage?

- How does slippage differ between centralized and decentralized exchanges?

Slippage | Imagine a novice crypto trader, eager to make their first trade, sees a crypto priced at $2,000 and decides to buy. They place a market order, expecting to acquire the asset at that price. However, by the time the order executes, the price has shifted to $2,200. This unexpected difference is known as slippage.

Slippage refers to the disparity between the expected price of a trade and the actual price at which it is executed. In the fast-paced and often volatile world of cryptocurrency, such discrepancies are common and can significantly impact trading outcomes.

For beginners, understanding slippage is crucial. Without this knowledge, they may find their trading strategies disrupted and profits diminished. Flashift delves into the mechanics of slippage in crypto trading, exploring its causes, implications, and strategies to mitigate its impact.

Understanding Slippage in Cryptocurrency Markets

Slippage occurs when there’s a difference between the expected price of a trade and the actual price at which the trade is executed. This discrepancy can happen in any financial market but is particularly prevalent in the volatile world of cryptocurrencies. For instance, if you place an order to buy a crypto at $10,000, but the order executes at $10,200, the $200 difference is considered slippage.

Why Slippage Happens in Crypto Transactions

Several factors contribute to slippage in crypto trading:

- Market Volatility: Cryptocurrencies are known for their rapid price fluctuations. Between the time an order is placed and when it’s executed, the market price can change, leading to slippage.

- Liquidity: In markets with low liquidity, there may not be enough buy or sell orders at the desired price level. This scarcity can cause orders to be filled at less favorable prices.

- Order Size: Large orders can impact the market price, especially in less liquid markets, causing slippage as the order moves through different price levels to be fully executed.

- Execution Speed: Delays in order execution, whether due to network congestion or platform inefficiencies, can result in the market moving away from the expected price.

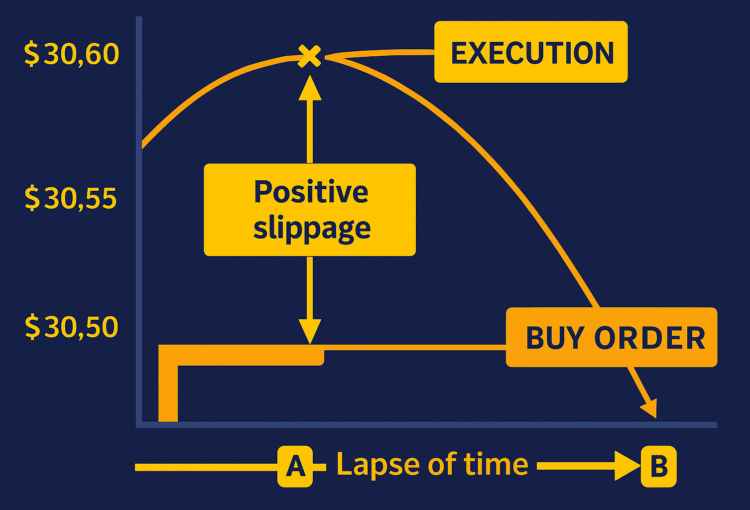

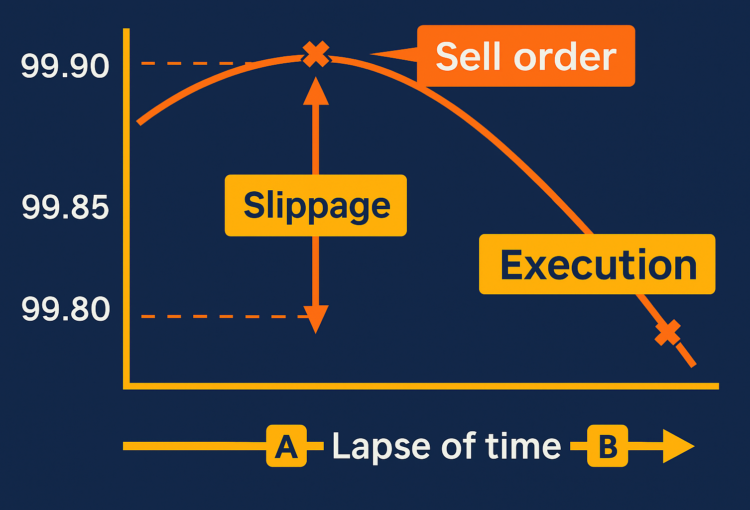

Positive vs. Negative Slippage Explained

Slippage isn’t always detrimental; it can be:

- Positive Slippage: Occurs when a trade is executed at a better price than expected. For example, if you place a buy order at $1.50, but it executes at $1.45, you’ve benefited from positive slippage.

- Negative Slippage: Happens when a trade is executed at a worse price than anticipated. For instance, if you intend to sell at $2.00, but the order fills at $1.95, you’ve experienced negative slippage.

Read More: Isolated vs Cross Margin: What Every Crypto Trader Should Know in 2025

Key Factors Contributing to Slippage

Here, you will gain a better understanding of the factors that contribute to slippage, and can avoid or minimise them as fast as you can:

Market Volatility and Liquidity

Cryptocurrency markets are known for their high volatility, with prices capable of significant fluctuations within short timeframes. This volatility means that the price at which a trade is executed can differ from the expected price, leading to slippage.

Liquidity, or the availability of assets to buy or sell without causing drastic price changes, also plays a vital role. In markets with low liquidity, even small trades can lead to significant price movements, increasing the slippage. Conversely, high-liquidity markets tend to have tighter bid-ask spreads, reducing slippage risks.

Order Types and Execution Speed

The type of order placed can influence the degree of slippage experienced. Market orders, which execute immediately at the best available price, are more susceptible to slippage, especially in volatile or low-liquidity markets. Limit orders, on the other hand, set a specific price for execution, providing more control but potentially resulting in unfilled orders if the market doesn’t reach the desired price.

Execution speed is another critical factor. Delays in order processing, whether due to network congestion or platform inefficiencies, can result in trades being executed at less favorable prices than anticipated.

Trading Volume and Exchange Infrastructure

High trading volumes generally indicate a more active market, which can enhance liquidity and reduce slippage. However, during periods of extreme volume, exchanges may experience technical challenges, such as delayed order processing or system outages, which can exacerbate slippage.

The infrastructure of the trading platform also matters. Exchanges with robust, high-speed systems are better equipped to handle large volumes and rapid price changes, minimizing the risk of slippage. In contrast, platforms with outdated or overloaded systems may struggle during peak trading times, leading to increased slippage.

How Slippage Affects Traders

Slippage impacts retail and institutional traders differently due to variations in trade sizes, access to liquidity, and execution strategies.

- Retail Traders: Typically executing smaller trades, retail traders are more susceptible to slippage during periods of high volatility or low liquidity. Their orders may be filled at less favorable prices, especially when using market orders without predefined limits.

- Institutional Traders: Handling large volumes, institutional traders often employ advanced strategies such as algorithmic trading and access to over-the-counter (OTC) markets to minimize slippage. These methods allow for better price discovery and execution, reducing the adverse effects of slippage on large transactions.

Examples of Slippage in Real-World Trades

Real-world scenarios illustrate how slippage can affect trading outcomes:

- High-Volatility Events: During sudden market movements, such as a rapid price drop, a trader placing a sell order for a crypto at $2,000 might find the order executed at $1,940 due to rapid price changes, a 3% negative slippage.

- Low-Liquidity Situations: Attempting to sell a large amount of a less-traded cryptocurrency may result in the order being filled at progressively lower prices, as there aren’t enough buyers at the desired price level, leading to significant slippage.

Risks for Scalpers, Bots, and Day Traders

Traders employing high-frequency strategies, such as scalping and day trading, are particularly vulnerable to slippage:

- Scalpers: Relying on small price movements for profit, scalpers can see their gains eroded by slippage, as even minor price discrepancies can offset the intended profit margins.

- Trading Bots: Automated trading systems executing numerous trades rapidly may encounter slippage due to latency issues or rapid market changes, affecting the overall effectiveness of the trading strategy.

- Day Traders: Engaging in multiple trades within a single day, day traders may experience cumulative slippage, which can significantly impact daily profitability if not properly managed.

Strategies to Minimize Slippage in Crypto Trading

Knowing about the strategies that can lead to gaining and saving more investments, let’s review them all in detail:

Use of Limit Orders vs. Market Orders

Market orders execute immediately at the best available price, which can lead to slippage, especially in volatile or low-liquidity markets. In contrast, limit orders allow traders to specify the exact price at which they are willing to buy or sell, ensuring that the trade only executes at the desired price or better. While limit orders provide price control, they may not fill if the market doesn’t reach the specified price. Utilizing limit orders is an effective way to mitigate slippage.

Choosing High-Liquidity Pairs and Exchanges

Trading pairs with high liquidity, such as BTC/USD or ETH/USDT, tend to have tighter bid-ask spreads, reducing the likelihood of slippage. Additionally, selecting exchanges known for deep liquidity and efficient order matching can further minimize slippage. Before executing trades, it’s advisable to assess the order book depth and trading volume of the chosen pair and platform.

Timing Trades During Low Volatility Periods

Market volatility significantly affects slippage. Executing trades during periods of lower volatility, such as outside of major economic announcements or during times of consistent market activity, can help reduce unexpected price movements. Monitoring market conditions and avoiding trades during highly volatile periods can be beneficial.

Advanced Tools: Slippage Tolerance Settings in DEXs

Decentralized exchanges (DEXs) often allow traders to set slippage tolerance, the maximum acceptable percentage difference between the expected and executed trade price. Adjusting slippage tolerance settings helps prevent trades from executing at unfavorable prices due to rapid market movements. It’s important to set this parameter carefully; too low may result in failed transactions, while too high could lead to significant slippage.

How Flashift Helps You Trade with Minimal Slippage

AI-Powered Rate Aggregation for Optimal Execution

Flashift employs advanced artificial intelligence to aggregate and analyze real-time data from different centralized and decentralized exchanges. This AI-driven system evaluates multiple factors, including transaction speed, user feedback, fee structures, and historical reliability, to identify the most favorable exchange routes for users. By doing so, Flashift ensures that traders receive the best possible rates with minimal slippage.

The platform’s intelligent tagging system further enhances user experience by categorizing exchange options with labels such as “AI Best Rate,” “Recommended,” and “Best in KYC.” These tags assist users in making informed decisions quickly, reducing the time spent on manual comparisons and mitigating the risk of unfavorable price movements during the trading process.

Non-Custodial Trading Without Hidden Slippage

Flashift operates as a non-custodial exchange aggregator, meaning it does not hold users’ funds during transactions. This approach eliminates the risks associated with centralized custody, such as exchange hacks or mismanagement of assets. Users retain full control over their private keys and funds throughout the trading process.

Moreover, Flashift offers a transparent trading environment with zero hidden fees. By providing clear information on exchange rates and associated costs upfront, users can execute trades with confidence, knowing that the final transaction amount will align closely with their expectations.

In summary, Flashift’s combination of AI-powered rate aggregation and non-custodial, transparent trading practices equips users with the tools necessary to minimize slippage and execute efficient, secure cryptocurrency trades.

Final Thoughts on Managing Slippage in Crypto

Slippage is an inherent aspect of cryptocurrency trading, particularly given the market’s volatility and varying liquidity levels. While it cannot be entirely eliminated, understanding its causes and implementing effective strategies can significantly mitigate its impact.

Utilizing limit orders allows traders to set specific price points for transactions, reducing the likelihood of unexpected price changes during execution. Trading during periods of high liquidity and low volatility can also minimize slippage, as there are more participants in the market and prices are more stable. Additionally, breaking large orders into smaller segments can prevent substantial price shifts caused by single, large transactions.

Platforms like Flashift offer tools to help manage slippage effectively. By aggregating rates from multiple exchanges and providing AI-powered execution strategies, Flashift aims to optimize trade outcomes and reduce the adverse effects of slippage.

In conclusion, while slippage is a common challenge in crypto trading, being informed and proactive can help traders navigate it successfully. By employing strategic trading practices and leveraging advanced tools, traders can enhance their trading efficiency and protect their investments.

FAQs

-

What is slippage in crypto trading?

Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. This discrepancy often occurs in volatile markets or when there’s low liquidity, leading to trades being filled at prices different from those anticipated.

-

Why does slippage occur in cryptocurrency markets?

Slippage can result from:

- Market Volatility: Rapid price fluctuations can cause execution prices to differ from expected prices.

- Low Liquidity: Insufficient buy or sell orders at desired price levels can lead to trades being executed at less favorable prices.

- Large Order Sizes: Executing sizable trades can impact market prices, especially in thinly traded markets.

-

What is slippage tolerance, and how does it work?

Slippage tolerance is a setting that defines the maximum percentage difference between the expected and actual execution price a trader is willing to accept. If the price moves beyond this threshold during execution, the trade may fail or be rejected.

-

How can I minimize slippage in my trades?

To reduce slippage:

- Use Limit Orders: Set specific prices at which you’re willing to buy or sell, ensuring trades execute only at desired prices.

- Trade During High Liquidity Periods: Engage in trading when markets are most active to benefit from tighter bid-ask spreads.

- Avoid Trading During Major News Events: Significant announcements can cause heightened volatility, increasing slippage risks.

-

What is the difference between positive and negative slippage?

- Positive Slippage: Occurs when a trade is executed at a better price than expected, benefiting the trader.

- Negative Slippage: Happens when a trade is executed at a worse price than anticipated, potentially leading to losses.

-

Are certain trading strategies more susceptible to slippage?

Yes. High-frequency trading strategies, such as scalping and day trading, are more vulnerable to slippage due to their reliance on rapid trade execution and small price movements. In such strategies, even minor slippage can significantly impact profitability.

-

How does slippage differ between centralized and decentralized exchanges?

- Centralized Exchanges (CEXs): Generally offer higher liquidity and faster execution speeds, potentially resulting in lower slippage.

- Decentralized Exchanges (DEXs): May experience higher slippage due to factors like lower liquidity, network congestion, and reliance on automated market makers.