By late 2025, the cryptocurrency market had moved past the speculative frenzy of “ETH Killers.” The narrative has matured. Investors and institutions are no longer looking for promises; they are looking for execution at scale.

In this environment, Sui (SUI) has emerged not just as a competitor, but as a fundamental reimagining of blockchain architecture. While the market was distracted by the ETF approvals of 2024, Sui quietly deployed two ground-breaking upgrades Mysticeti and Pilotfish, that solved the latency issues plaguing high-frequency trading and gaming.

However, as the technical landscape improves, the regulatory landscape has darkened. The surge in centralized exchange (CEX) account freezes throughout 2025 has made “self-custody” a survival mechanism, not just a preference.

This guide is not a basic overview. It is a strategic analysis for the sophisticated investor. We will dissect Sui’s object-centric model, analyze the institutional signal from the recent Bitwise ETF filing, and demonstrate how to acquire SUI securely using Flashift’s privacy-preserving, non-custodial aggregator.

The Technical Architecture of Sui

To understand why Sui is flipping legacy chains in daily active addresses, you must understand the difference between “Accounts” and “Objects.”

The “Object-Centric” Revolution

While Solana pioneered parallel processing in crypto with its Sealevel runtime (which requires developers to declare dependencies upfront), Sui takes this a step further with its object-centric data model.

Solana’s approach is effective but rigid. Sui, however, views the chain as a collection of distinct “Objects.”

Why it matters: Because Sui knows that a simple token transfer usually doesn’t affect the rest of the network, it can process these transactions in parallel by default. This “optimistic” approach allows for massive throughput without the complexity required by older parallel systems.

Mysticeti & Pilotfish: The 2025 Upgrades

In mid-2025, Sui deployed Mysticeti, a new consensus protocol that reduced consensus latency to ~390 milliseconds. This makes Sui one of the fastest chains for “Time to Finality,” beating Solana’s average of ~800ms.

Furthermore, the Pilotfish upgrade allows validators to scale horizontally. Instead of buying a supercomputer to run a node (the Solana approach), a Sui validator can simply add more standard servers to handle more traffic. This is “elastic scaling” brought to crypto.

The “Move” Safety Net

Sui is built on Move, a language designed by Meta for the Diem project. Unlike Solidity, which is prone to reentrancy attacks (the bug behind billions in hacks), Move treats assets as “Resources” that cannot be cloned or destroyed by accident. While no code is bug-free (as seen in the May 2025 Cetus incident), Move significantly raises the baseline for smart contract security.

Why SUI Matters in 2026?

The Bitwise ETF Signal

On December 20, 2025, Bitwise filed for a Spot Sui ETF. This is a massive validation signal. It suggests that institutional asset managers view Sui not as a speculative altcoin, but as “infrastructure-grade” technology alongside Bitcoin and Ethereum. For retail investors, accumulating SUI before potential ETF approval is a key strategic play for the 2026 cycle.

Gaming & Consumer Apps (zkLogin)

Mass adoption won’t come from seed phrases. It will come from zkLogin, Sui’s native primitive that allows users to sign transactions using their Google or Twitch accounts. Combined with the launch of the SuiPlay0x1 handheld gaming device, Sui is positioning itself as the backend for Web3 gaming.

Read More: Exploring Sui Blockchain: A Fast and Scalable Layer 1

Where to Buy SUI?

As we move into 2026, savvy investors are becoming increasingly aware of “Counterparty Risk”, the risk that a third party might not be able to fulfill their obligations instantly.

The Centralized Exchange (CEX) Trade-Off

Using major exchanges like Coinbase or Binance is convenient, but it involves giving up custody of your assets. In recent years, increased regulatory scrutiny has led to stricter compliance measures.

The Potential Risk: Users occasionally report delays in withdrawals or temporary account restrictions due to routine “security reviews” or updated AML policies. While usually resolved, these delays can prevent you from trading or moving funds during critical market moments.

The Self-Custody Solution: Flashift

For those who prefer to eliminate third-party dependency, the non-custodial swap is the industry standard for sovereignty.

Flashift aggregates liquidity from vetted providers who execute swaps without holding your funds.

Your Keys, Your Crypto: Assets move directly from your wallet to the destination.

Privacy-Focused: By using the “Best in KYC” tag, our AI identifies routes with streamlined verification processes, minimizing the likelihood of friction while keeping you compliant.

Read More: Sui Price Surge: Can Sui Continue to Outperform the Cryptocurrency Market?

Sui vs. Solana vs. Ethereum

| Feature | Sui (SUI) | Solana (SOL) | Ethereum (ETH) |

| Architecture | Object-Centric (Optimistic) | Account-Based (Sealevel) | Account-Based (Sequential) |

| Time to Finality | ~390ms (via Mysticeti) | ~800ms | ~12 Minutes |

| Scaling Strategy | Horizontal (Pilotfish) | Vertical (Hardware Scaling) | Layer-2 Rollups |

| Stability | Recovered (Post-Nov 2024 Fixes) | 100% Uptime (Last 16 Months) | 100% Uptime |

| Parallel Processing | Native (Object-Based) | Native (Sealevel) | No (Sequential) |

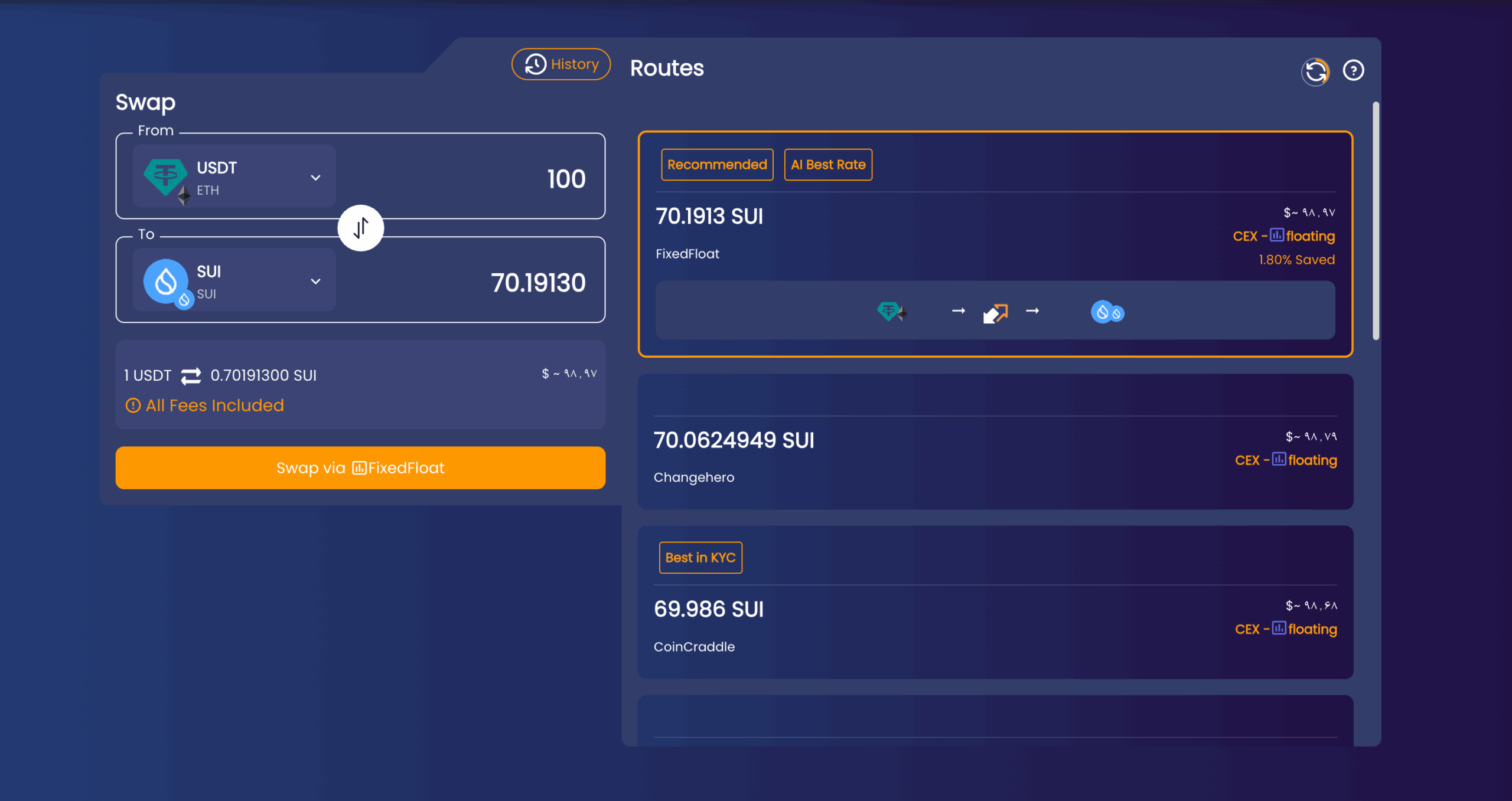

How to Swap SUI via Flashift

Don’t just swap; swap intelligently. Flashift’s AI engine allows you to filter for the specific attributes that matter to you.

Step-by-Step Guide:

-

Open Flashift and Choose Your Assets.

- Select Pair: Input USDT and output Sui (SUI).

- Enter the Swap Amount

- Analyze the AI Tags:

Best in KYC: Choose this if privacy is your #1 priority. The AI checks historical data to find providers with lenient AML triggers.

Best Rate: Choose this for maximum ROI. The AI calculates slippage and network fees to find the true lowest cost.

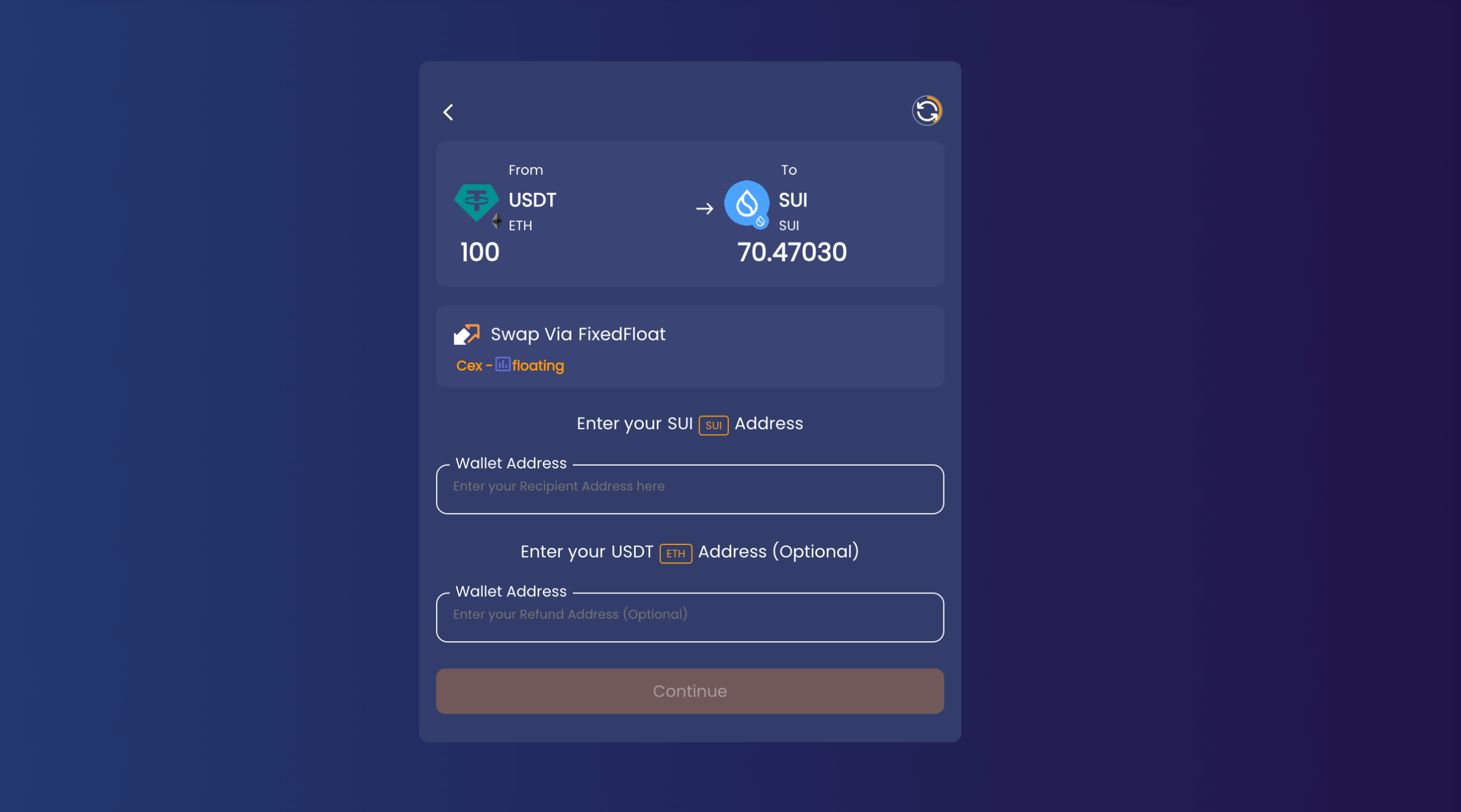

- Enter Destination: Input your Sui Wallet address.

-

Review Details and Confirm.

-

Send USDT to the Provided Address.

-

Receive Your Swapped Asset.

Conclusion

Sui is no longer just a “promising project.” With the deployment of Mysticeti, the filing of the Bitwise ETF, and the success of zkLogin, it has cemented itself as a top-tier Layer-1 blockchain for the 2026 cycle.

While Solana focuses on brute-force hardware scaling and Ethereum relies on complex Layer-2s, Sui offers a uniquely elegant solution: horizontal scaling through an object-centric model.

For the investor, the opportunity is clear. But the method of entry matters. In an era of increasing surveillance and exchange freezes, Flashift offers the essential toolset, privacy, speed, and self-custody, to participate in the Sui ecosystem on your own terms.

FAQ

- Is SUI truly faster than Solana in 2026?

In terms of “Time to Finality,” yes. With the Mysticeti upgrade, Sui achieves consensus in ~390ms compared to Solana’s ~800ms. However, both are exceptionally fast compared to legacy chains. - What makes Flashift different from a normal exchange?

Flashift is a non-custodial aggregator. We do not hold your funds. Instead, our AI searches multiple independent exchange providers to find the best rate and privacy conditions (“Best in KYC”) for your swap, executing it instantly without requiring you to create an account. - What is the “Best in KYC” tag?

This Flashift exclusive feature uses AI to analyze the verification habits of our partners. It flags the route that has the historically lowest probability of asking for ID documents, making it the preferred choice for privacy-focused traders.