For a while, Solana was the easy target. Outages, criticism, doubt; then silence. But beneath that quiet stretch, the network was being rebuilt piece by piece. Core upgrades stabilized performance, developers never really left, and new liquidity slowly found its way back. That’s why the conversation today feels more grounded. When people talk about Solana price 2026 or planning to buy Solana 2026, it’s no longer blind optimism; it’s a response to visible progress on-chain.

This piece unpacks why Solana’s comeback isn’t just another relief rally. It also focuses on execution, not theory. Knowing how and when to swap SOL has become a practical skill, especially as capital rotates faster between ecosystems.

Solana comeback post-FTX

After FTX collapsed, Solana didn’t just lose price; it lost trust by association. The chain was labeled “guilty by proximity,” and for months SOL traded under a cloud that had little to do with the network itself. What followed wasn’t a flashy recovery, but a slow, technical reset. Validators stayed online, core developers kept shipping upgrades, and new teams quietly filled the gap left by exiting players. That post-FTX period forced Solana to mature fast, and it shows in how the network operates today.

As liquidity returned and on-chain activity picked up, users began moving back in. Not out of nostalgia, but out of necessity. Fast settlement, low fees, and a growing DeFi and NFT layer made Solana relevant again. For many traders, the first step back wasn’t buying spot, it was learning when to swap SOL efficiently as capital rotated from other chains. That practical shift is a big part of Solana’s real comeback, not just the chart recovery.

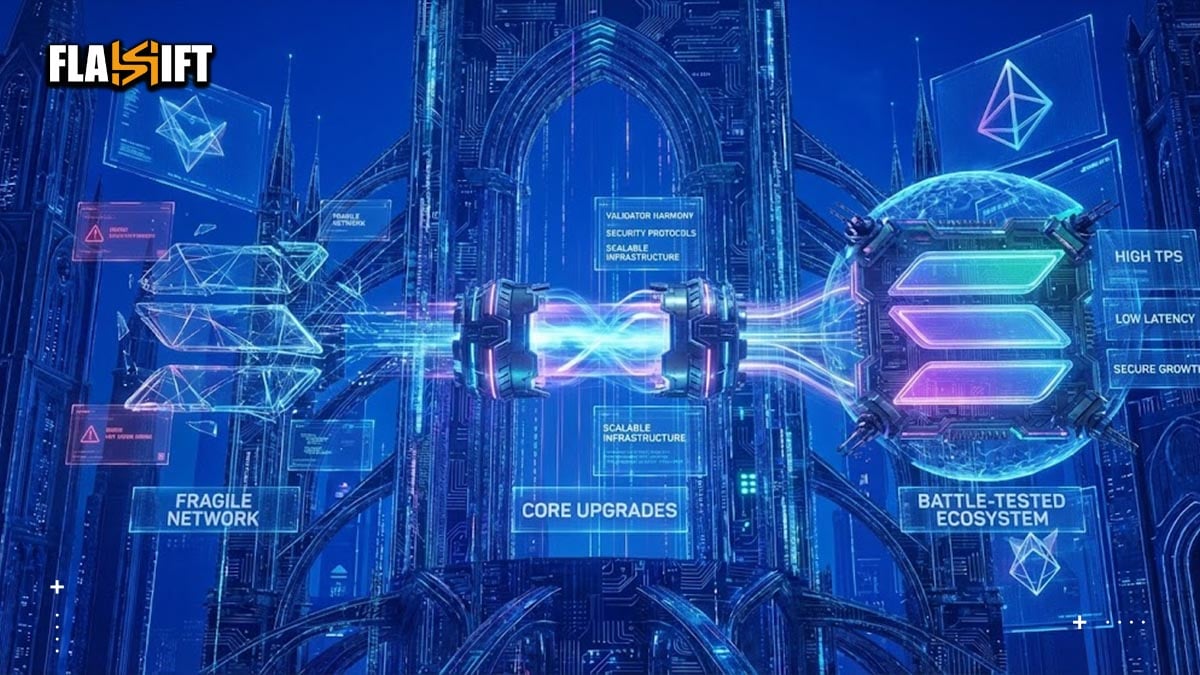

Solana tech & ecosystem growth | Core Network Upgrades: From Fragile to Battle-Tested

Solana’s technical turnaround didn’t come from marketing but it came from engineering. Post-FTX, the focus shifted hard toward stability. Upgrades to the validator client, better fee markets, and more predictable transaction processing reduced the kind of congestion that once defined the chain. The introduction of alternative clients like Firedancer wasn’t just a performance play; it was about decentralization at the software level. This is why long-term forecasts around Solana price 2026 now lean on infrastructure maturity rather than hype cycles.

Developer Activity and Tooling Expansion

One of the most overlooked signals in Solana’s recovery is developer retention. Despite the bear market, core teams kept building, and new tooling made onboarding easier than ever. Frameworks like Anchor matured, documentation improved, and debugging became less painful. As a result, Solana remains one of the few chains where developers can ship consumer-grade apps at scale. This matters for investors planning to buy Solana 2026.

DeFi Revival and Capital Efficiency

Solana’s DeFi ecosystem didn’t just come back; it evolved. Liquidity is now spread across more resilient protocols, with better risk controls and smarter incentives. Trading, lending, and liquid staking have become faster and cheaper compared to many competing chains. This efficiency is why active users often prefer to swap SOL instead of bridging elsewhere when market conditions change. Capital moves where friction is lowest, and Solana has leaned into that advantage.

NFTs, Gaming, and Consumer Apps

While NFTs cooled across the market, Solana quietly positioned itself as a chain for actual users—not just traders. Compressed NFTs, cheaper minting, and smoother UX opened the door for gaming, ticketing, and social applications. These aren’t speculative experiments; they’re attempts at onboarding non-crypto natives. If adoption continues at this layer, projections for Solana price 2026 will increasingly reflect usage metrics, not just macro cycles.

Ecosystem Funding and Institutional Interest

Another sign of growth is where the money is going. Instead of short-term grants, funding is now targeting infrastructure, wallets, developer tools, and compliance-friendly products. Institutions aren’t rushing in blindly—but they are testing Solana seriously. For market participants looking to swap SOL strategically or accumulate ahead of the next cycle, this slower, more deliberate capital flow is often a stronger signal than explosive price moves.

Why Execution Matters Going Forward

Solana’s comeback isn’t about promises anymore—it’s about execution. The tech stack is stronger, the ecosystem is broader, and the user base is more intentional. Whether you’re positioning early to buy Solana 2026, tracking realistic scenarios for Solana price 2026, or actively managing exposure and timing when to swap SOL, the network’s growth story now rests on fundamentals that are hard to ignore.

How to swap Solana using Flashift (Step-by-Step Tutorial)

Swapping Solana doesn’t need to be complicated, slow, or tied to a single wallet ecosystem. Flashift is designed for people who want speed, flexibility, and minimal friction, especially when timing matters. If your goal is to swap SOL easily, here’s how the process works from start to finish.

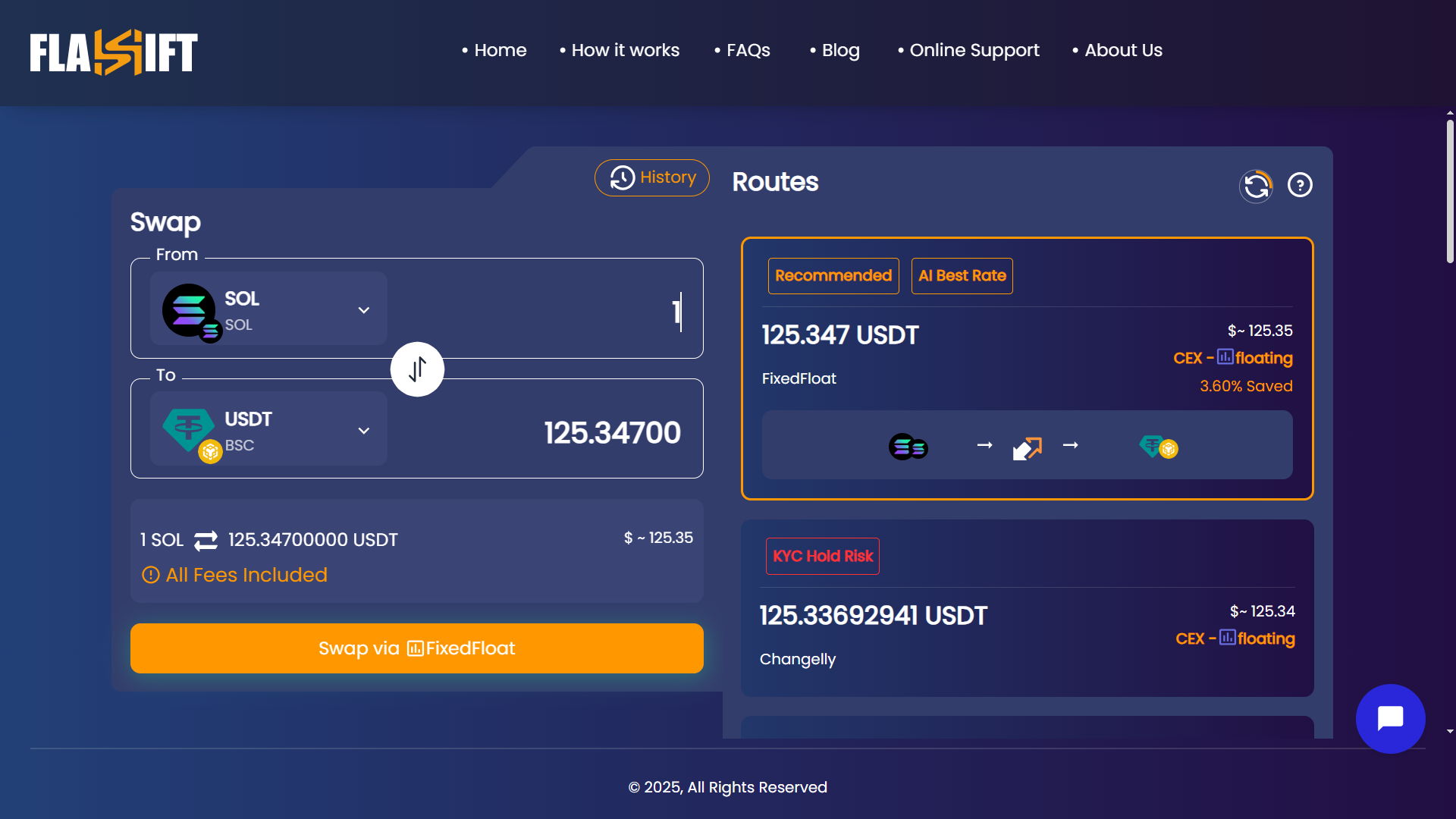

Step 1: Open Flashift and Choose Your Assets

Visit Flashift and select Solana (SOL) as the asset you’re swapping from. Then choose the coin or token you want to receive. Flashift supports a wide range of blockchains, so this step is where you define the direction of your swap. Whether you’re rotating capital or exiting SOL temporarily.

Step 2: Enter the Swap Amount

Input how much SOL you want to swap. Flashift will automatically calculate the estimated output based on live market rates. Then choose the exchange you want to use. Flashift’s AI makes it easy for you to select the best exchange.

Take a moment here to double-check the numbers. Precision matters more than speed at this stage.

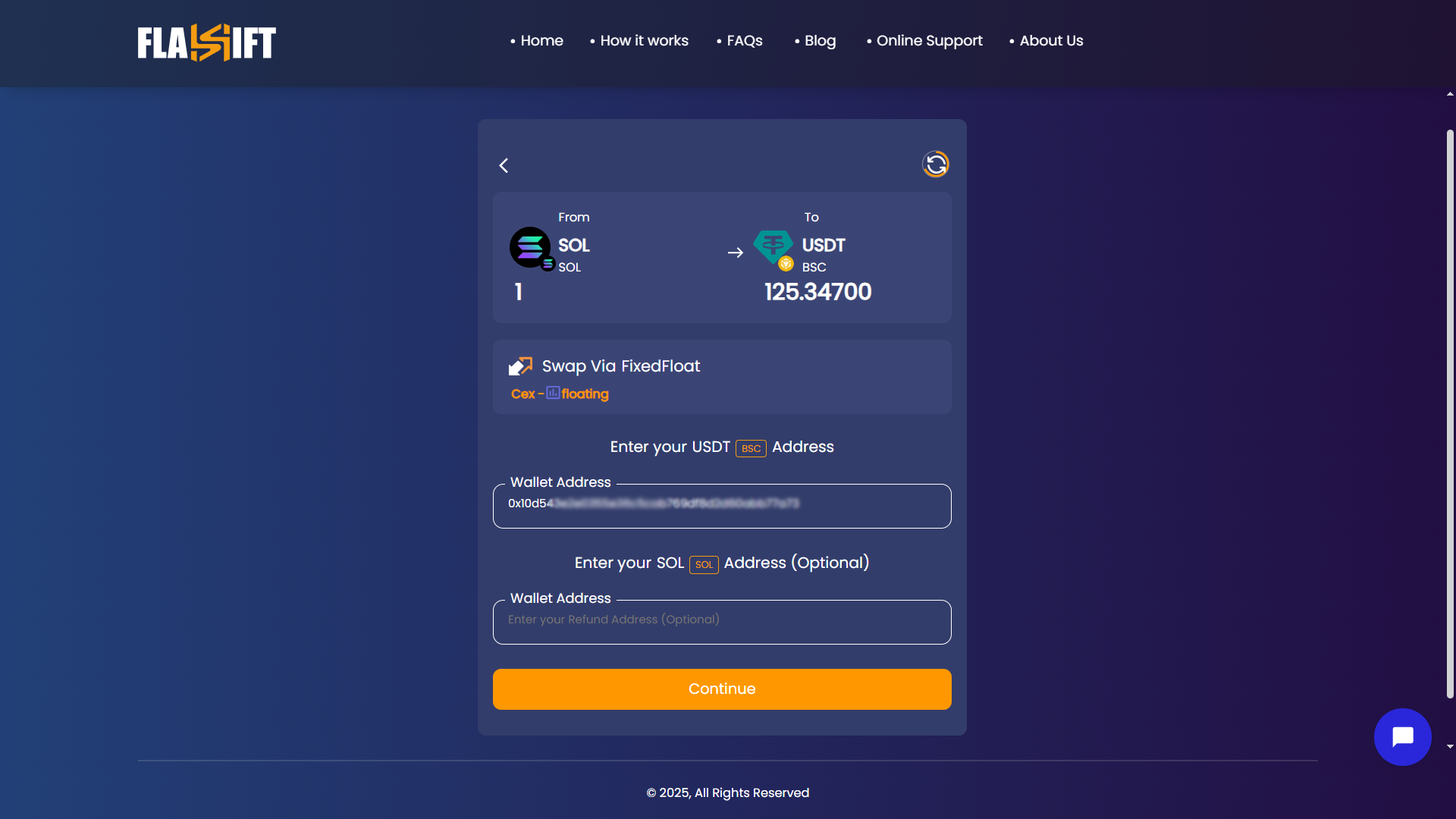

Step 3: Provide the Destination Address

Next, paste the wallet address where you want to receive the swapped asset. This could be a wallet on another chain or a different Solana-compatible address, depending on the swap. Always verify the address carefully, because this is a one-way transaction.

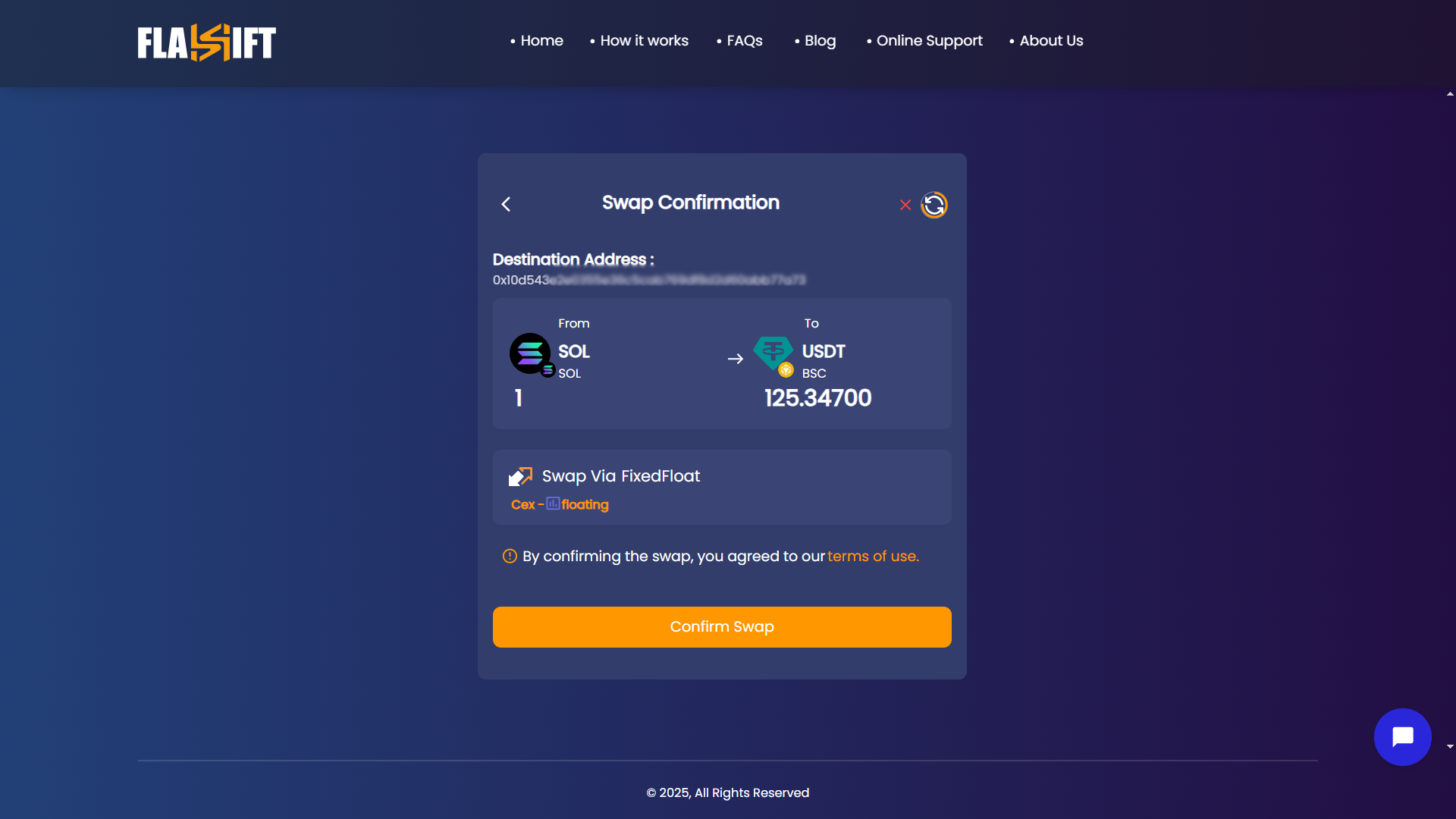

Step 4: Review Details and Confirm

Before moving forward, review everything: swap pair, amount, destination address, and network details. Flashift keeps this screen clean on purpose, so nothing important is buried. Once confirmed, proceed to generate the deposit address.

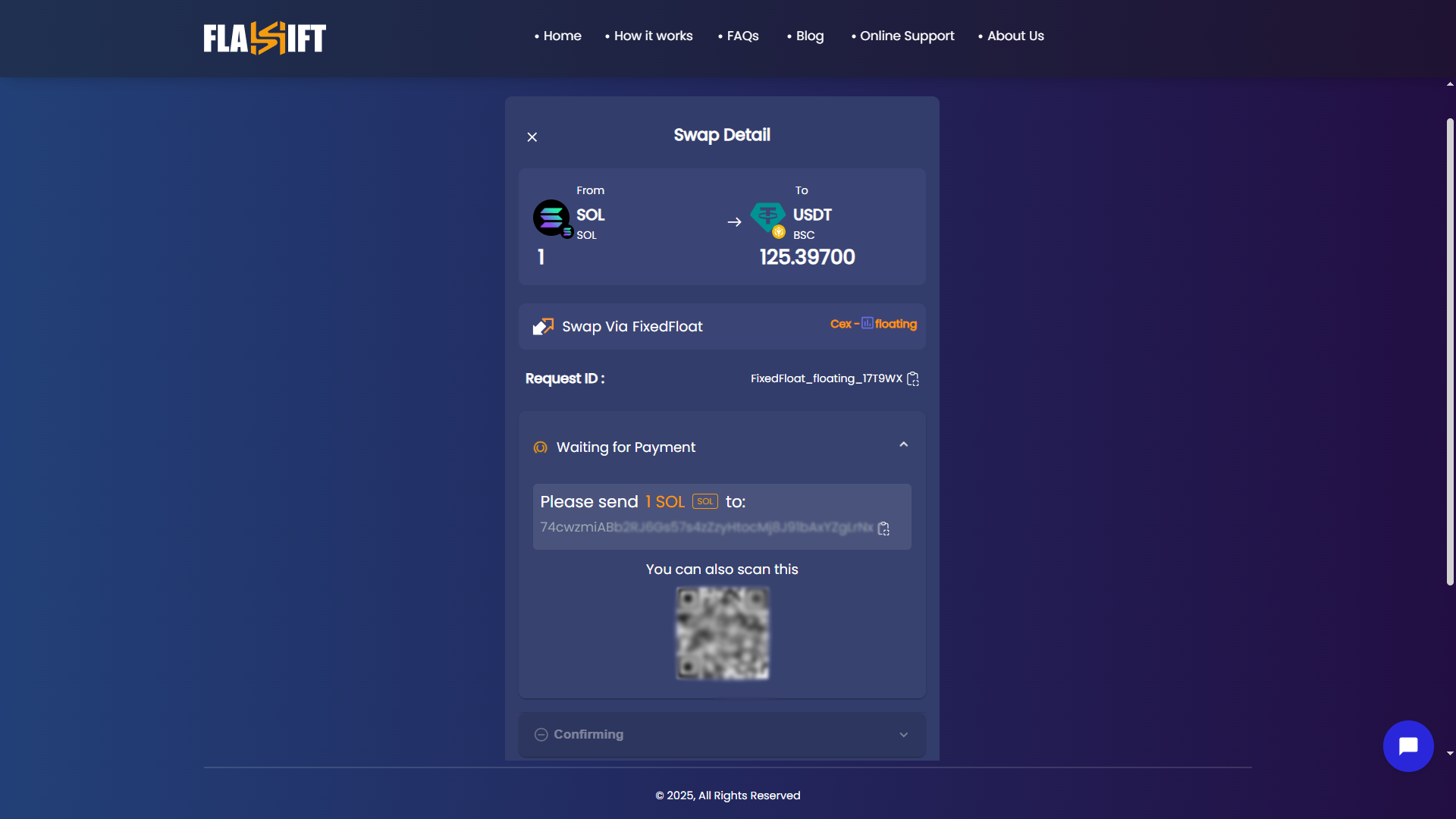

Step 5: Send SOL to the Provided Address

Send the exact amount of SOL from your wallet to the Flashift deposit address. Make sure you’re sending on the Solana network and not including extra funds. After the transaction is detected, Flashift handles the rest automatically.

Step 6: Receive Your Swapped Asset

Once the swap is completed, the destination asset is sent directly to your wallet. No accounts, no custody, no unnecessary delays. This is why many traders prefer Flashift when they need to swap SOL without locking themselves into complex workflows.

Final Notes on Timing and Execution

Flashift works best when you already know what you want to do. It’s built for execution, not hesitation. Whether you’re reacting to market structure, reallocating between chains, or managing risk, this method keeps the process clean and efficient—exactly how swapping SOL should feel.

FAQ

- Why did Solana recover faster than many expected after the FTX collapse?

Solana’s rebound wasn’t driven by price action alone. The key factor was continuity—validators stayed online, developers kept shipping upgrades, and the network never stopped processing transactions. While sentiment collapsed, the infrastructure didn’t. That gap between perception and reality is what allowed Solana to recover faster once trust slowly returned.

- Is Solana’s current growth more ecosystem-driven or market-cycle driven?

This phase leans heavily toward ecosystem growth. DeFi volume, developer activity, and consumer-facing apps are expanding even during uneven market conditions. That’s why projections around Solana price 2026 increasingly focus on usage metrics rather than pure bull-market momentum.

- When does it make more sense to swap SOL instead of buying or selling on an exchange?

Swapping SOL is often more efficient when rotating between chains, managing exposure without touching fiat, or reacting quickly to market structure shifts. Tools like Flashift reduce friction, making swaps practical during volatility rather than something reserved for long-term reallocations.

- Does improving network stability actually impact long-term SOL valuation?

Yes, directly. Stability affects everything from institutional interest to user retention. Fewer outages mean more reliable DeFi, better UX for consumer apps, and lower risk for capital deployment. Over time, that reliability feeds into how investors evaluate buy Solana 2026 scenarios.

- What’s the biggest mistake people make when swapping SOL across chains?

Rushing the process. Most errors happen at the address or network-selection stage, not because of the platform itself. Taking an extra minute to verify details is far more important than chasing a slightly better rate, especially when timing and execution are already in your favor.