If your goal is to swap to Arbitrum (or any ETH L2s), interact with L2-native dApps, or reduce gas costs, you’ll need a reliable ETH L2 bridge or a fast swap route (Like Flashift.app). We’ll cover the safest ways to bridge or swap ETH across Layer-2 networks without unnecessary steps, delays, or custodial risk.

Ethereum’s Layer-2 ecosystem in 2026 is no longer “experimental”, it’s core infrastructure. Rising L1 fees, modular rollups, and faster finality have pushed users toward L2s like Arbitrum, Optimism, Base, zkSync, and Starknet. If you’re still operating only on mainnet, you’re likely overpaying and underutilizing Ethereum.

This update breaks down what changed in Ethereum L2s in 2026, what actually matters for users (fees, speed, liquidity), and when it makes sense to move funds off L1. No theory, just practical context.

Optimism vs Arbitrum (Quick Comparison of two major layers)

| Feature | Optimism | Arbitrum |

| Rollup type | Optimistic rollup | Optimistic rollup |

| Typical transaction fees | Low | Very low |

| Transaction speed | Fast | Very fast |

| DeFi liquidity | Strong | Very strong |

| Ecosystem focus | Public goods, OP Stack | DeFi, trading, liquidity |

| Major advantage | Ecosystem expansion | Scale and liquidity depth |

| ETH L2 bridge support | Widely supported | Widely supported |

| Best use case | Apps and long-term builders | Traders and active DeFi users |

⚡ ETH Scaling Update in 2026

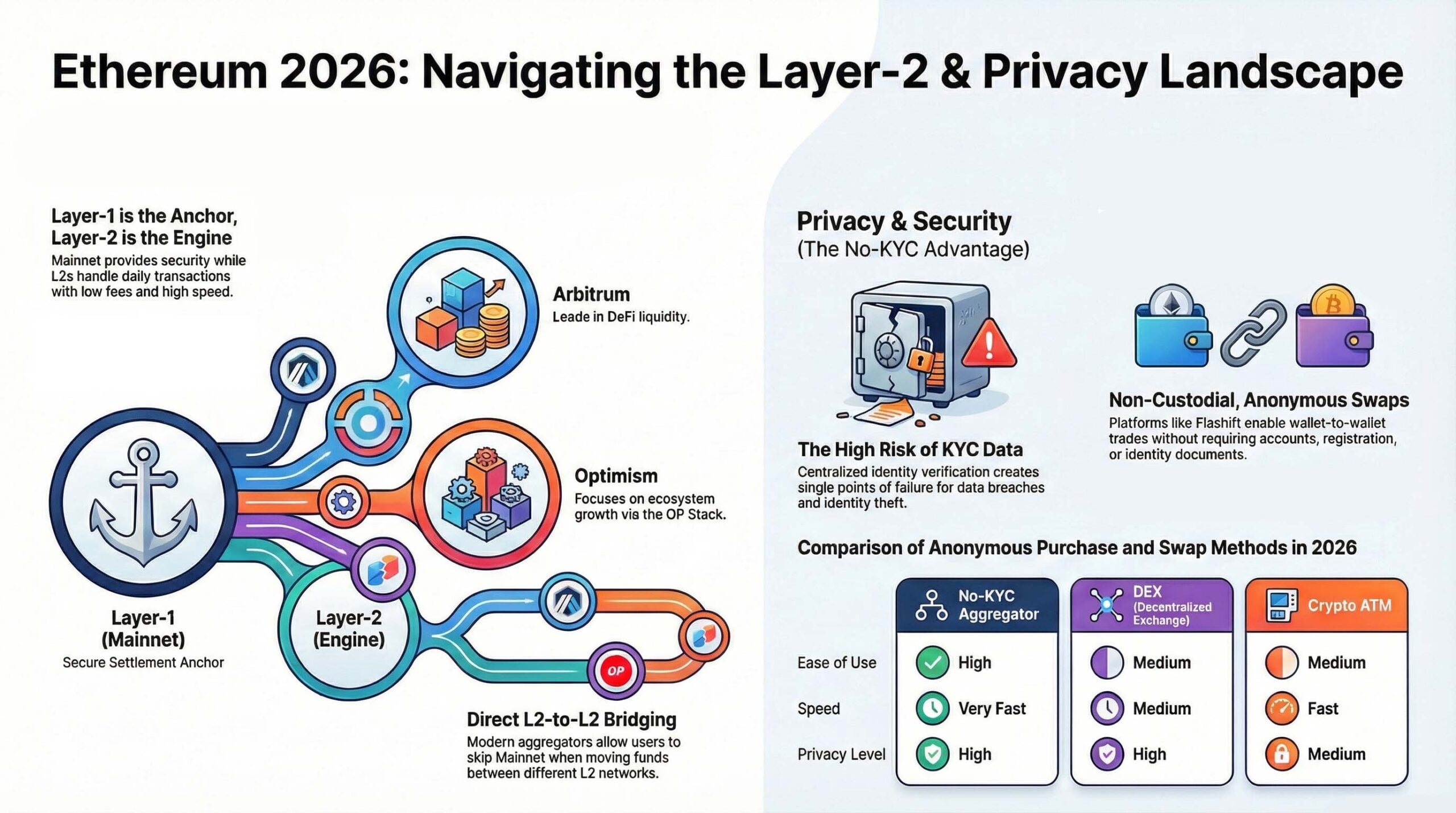

Ethereum scaling in 2026 is clear and practical. The network didn’t try to make Layer-1 faster for everyone. Instead, it pushed real usage to Layer-2 while keeping security on mainnet.

Layer-2 is where activity lives

Most transactions now happen on Arbitrum, Optimism, zkSync, and Starknet. Fees are low, confirmation is fast, and apps feel smooth. For daily users, Ethereum means L2 first.

ETH L2 bridge is part of normal usage

Using an ETH L2 bridge is no longer a technical task. It’s:

- Quick (usually a few minutes)

- Non-custodial

- Built into wallets and swap aggregators

Users move ETH to L2 to save fees, not to experiment.

Rollups are more mature

Optimistic rollups still lead in volume. ZK rollups are closing the gap with:

- Faster finality

- Stronger security models

- Better scalability for the long term

Both work under Ethereum’s security.

Mainnet’s new job

Ethereum Layer-1 focuses on:

- Security

- Data availability

- Final settlement

It’s the base layer, not the place for cheap daily transactions.

Bottom line

Ethereum scaling in 2026 is already here. If you’re not using an ETH L2 bridge, you’re paying more than you need to. L2 is the standard; Mainnet is the anchor.

Major Ethereum Layer-2s Explained (What Each One Is Best At)

Below is a clear, user-first breakdown of the main Ethereum L2s today, what they do well, who should use them, and how they compare. No filler, just signal.

Arbitrum

Best for: DeFi, active traders, deep liquidity

Arbitrum is the most used Ethereum L2 by volume and TVL. It’s fast, stable, and widely supported by dApps. Why users swap to Arbitrum:

- Lowest fees among major optimistic rollups

- Huge DeFi ecosystem (GMX, Uniswap, Aave, perpetuals)

- Strong support across wallets and bridges

Using an ETH L2 bridge to Arbitrum is simple and widely integrated. For many users, Arbitrum is the default L2.

Optimism

Best for: Apps, ecosystems, long-term builders

Optimism focuses on sustainability and ecosystem growth through the OP Stack. It powers multiple chains, including Base. Key strengths:

- Stable and predictable fees

- Strong governance and public-goods funding

- Home to major protocols and infrastructure

Optimism vs Arbitrum in practice:

Optimism is cleaner and ecosystem-driven. Arbitrum is more liquidity-heavy and trader-focused.

Bridge Arbitrum to Optimism via Flashift.app:

Base

Best for: Retail users, onboarding, simple UX

Base is built on the OP Stack and backed by Coinbase. It benefits from easy fiat on-ramps and strong distribution. Why it’s growing fast:

- Massive user inflow from Coinbase

- Low fees and simple UX

- Fast integration with consumer apps

Technically similar to Optimism, but adoption is much more retail-focused.

zkSync Era

Best for: Speed, ZK tech, future scalability

zkSync uses zero-knowledge proofs instead of fraud proofs. This means faster finality and stronger security assumptions. What stands out:

- Near-instant confirmation

- Lower long-term costs

- Growing DeFi and NFT activity

Bridging ETH here via an ETH L2 bridge is improving quickly as tooling matures.

Starknet

Best for: Advanced DeFi, long-term scaling

Starknet is not fully EVM-compatible and uses Cairo. This slows adoption but allows deeper scalability. Strengths:

- Powerful ZK architecture

- High throughput potential

- Designed for complex financial apps

Not beginner-friendly, but technically one of the strongest L2s.

Linea

Best for: UX, wallets, EVM compatibility

Linea is built by ConsenSys and integrates tightly with MetaMask. Why users like it:

- Clean UX

- Full EVM compatibility

- Easy ETH L2 bridge access

Good choice for users who want simplicity without learning new tools.

Polygon zkEVM

Best for: Enterprises and Ethereum alignment

Polygon zkEVM brings ZK security with familiar EVM tooling. Key points:

- Strong enterprise focus

- Ethereum-aligned roadmap

- Slower growth, but solid infrastructure

Scroll

Best for: Ethereum purists and decentralization

Scroll aims to stay as close to Ethereum’s core philosophy as possible. Why it matters:

- Strong decentralization focus

- Native zkEVM design

- Still early, but technically clean

Final takeaway

- Swap to Arbitrum if you want liquidity and DeFi depth

- Choose Optimism for ecosystem stability

- ZK rollups are the future, but optimistic rollups still dominate today

- An ETH L2 bridge is now standard Ethereum usage, not an advanced feature

Ethereum didn’t scale by changing the base layer, it scaled by building around it.

🔗 How to Bridge / Swap to Ethereum L2s (Secure, Fast, and Easy)

Before aggregators and one-click swaps, Ethereum users relied on official L2 bridges. This is still the most direct and protocol-native way to move ETH to Layer-2.

Below is the traditional method, using the main platforms that power Ethereum L2 bridging.

The traditional ETH L2 bridge (official platforms)

Each Layer-2 runs its own native bridge, fully controlled by the L2 protocol itself.

Main platforms used

- Arbitrum Bridge (for Arbitrum One & Nova)

- Optimism Gateway (for Optimism)

These are considered the canonical ETH L2 bridge solutions.

How the process works (step by step)

- Connect your wallet (usually MetaMask)

- Choose Ethereum Mainnet as the source

- Select the target L2 (Arbitrum or Optimism)

- Approve and send ETH

- ETH is locked on L1 and credited on L2

No middlemen. No liquidity providers. Pure protocol logic.

Pros and Cons of official ETH L2 bridges

| Pros | Cons |

| Highest security level

|

High Ethereum gas fees |

| Fully non-custodial

|

Slow exits to mainnet |

| Maintained by the protocol itself | Not optimized for frequent swaps |

| * This is why large transfers still prefer the native route | *This makes it less practical for active users. |

So, the traditional way to bridge ETH to Layer-2 uses official platforms like Arbitrum Bridge and Optimism Gateway. It’s the slowest and most expensive.

That’s why many users comparing optimism vs arbitrum now use faster swap-based solutions, while still trusting native bridges as the security baseline. What is the best opstion to bridge/swap Ethereum Layer-2s?

Bridge ETH Layers: Flashift Integrations ⚡

Flashift is a fast, safe, and easy platform built for bridging and swapping across Ethereum Layer-2s. Instead of using slow native bridges, Flashift connects you to the best routes automatically. Here’s how its integrations make that possible 👇:

Multi-bridge routing

Flashift integrates with multiple ETH L2 bridge providers under the hood. It compares routes in real time and selects the fastest and most cost-efficient option for your swap.

You don’t need to search the best routes, Flashift does it for you!

Major Ethereum L2 support

Flashift supports leading Layer-2 networks, including:

- Arbitrum

- Optimism

- Base

- zkSync Era

- Polygon zkEVM

- Linea

This makes it easy to swap to Arbitrum or move funds between L2s without touching Ethereum mainnet directly. Visit “Flashift ExchangeV3” and input your tokens to bridge and swap.

Cross-chain & L2-to-L2 swaps

Unlike traditional bridges, Flashift allows:

- Ethereum → L2

- L2 → Ethereum

- L2 → L2

- Anything ⇄ Anything

This is a major advantage when comparing optimism vs arbitrum, where users often want to move liquidity quickly between ecosystems.

Non-custodial execution

Flashift never holds user funds.

- Wallet-to-protocol interaction

- No account required

- No KYC

Security stays at the protocol level.

Aggregated liquidity sources

Flashift connects to multiple liquidity providers and swap protocols. This improves: Execution speed, Price efficiency and, Swap success rate. Especially useful during high network congestion.

User-first UX

All integrations are abstracted into one flow:

- One interface

- One transaction path

- No manual bridge steps

Users focus on the result, not the infrastructure.

Final Words

Flashift integrations turn complex Ethereum scaling into a simple action. Instead of choosing between bridges or worrying about optimism vs arbitrum, users get the fastest path, automatically.

That’s why Flashift fits perfectly into the modern ETH L2 workflow.

Try Flashift and it will be your last choice 👍

FAQ

- Is using an ETH L2 bridge always cheaper than staying on mainnet?

Not always. For small or one-time transactions, Ethereum mainnet fees can sometimes be comparable. The real savings appear when you make multiple transactions on L2 after bridging.

- Why do some users prefer to swap to Arbitrum instead of Optimism?

Liquidity depth is the main reason. Arbitrum hosts more active DeFi protocols and trading volume, which can mean better pricing and faster execution compared to Optimism.

- What’s the real risk difference between official bridges and platforms like Flashift?

Official bridges minimize protocol risk but introduce time risk (slow withdrawals). Aggregated platforms reduce waiting time but rely on external liquidity. It’s speed vs maximum protocol purity.

- In optimism vs arbitrum, does the bridge choice affect security?

No. Both use optimistic rollups with similar security assumptions. The difference is not the bridge mechanism, but how quickly and efficiently users can move liquidity inside each ecosystem.

- Can I move funds directly between L2s without returning to Ethereum?

Yes. Modern platforms like Flashift.app allow L2-to-L2 swaps, skipping mainnet entirely. This is now one of the most efficient ways to rebalance capital across Ethereum Layer-2s.