Have you ever tried to move USDT from the Tron network to Ethereum, only to find yourself losing $25 in gas fees or getting stuck in a sudden KYC verification loop?

If you are a DeFi user in 2025, you know the struggle: Liquidity is fragmented, bridges are often slow, and finding the best cross-chain aggregator feels like searching for a needle in a haystack. You want to know which platform will give you the most crypto for your money, with the highest security and the least amount of friction.

The Short Answer for 2025:

For users prioritizing privacy and transaction success rates, Flashift stands out by using AI to filter offers based on “Best in KYC” and “AI Best Rate.” While Rango offers excellent multi-chain pathfinding across 77+ chains and Li.Fi powers the infrastructure for developers, Flashift provides a unique user-centric experience by aggregating trusted exchange providers rather than just bridges.

In this guide, we perform a deep dive and a real-world swap test comparing Flashift, Rango, and Li.Fi, to see which DeFi aggregator actually delivers the best value in 2025.

Why cross-chain aggregators matter

In the early days of crypto, swapping tokens meant moving funds to a centralized exchange (CEX), selling them, buying a new token, and withdrawing them again. This was slow, expensive, and required trusting a third party with your assets. Cross-chain aggregators solved this, but in 2025, the challenge has evolved.

The Fragmentation Problem: Why bridging is still hard in 2025

Despite the rise of Layer-2 solutions and interoperability protocols, liquidity is more fragmented than ever. You have assets on Solana, liquidity on Arbitrum, and NFTs on Ethereum. A standard “bridge” connects two specific chains (e.g., Polygon to Ethereum). However, if you want to swap BTC to USDT on Avalanche, a single bridge cannot help you.

This is where a DeFi aggregator steps in. It scans dozens of bridges (like Stargate, Celer, Hop) and independent exchange services to find a route. The best cross-chain swap platforms in 2025 don’t just find a route; they find the efficient route, preventing you from paying 3% slippage on a simple trade.

Non-custodial swaps

The collapse of several centralized entities in the past few years taught us one lesson: Not your keys, not your coins.

The defining feature of top-tier aggregators like Flashift, Rango, and Li.Fi is that they operate on a non-custodial basis, though the mechanisms differ:

- No Accounts Required: Unlike centralized exchanges (CEXs), you do not create an account or hold a balance on the aggregator platform itself.

- Smart Contract vs. Provider Routing: Platforms like Li.Fi and Rango typically route funds via smart contracts that interact with bridges. Flashift operates as an aggregator of vetted exchange partners, where you send funds to a generated address for execution.

- Key Control: In all these cases, you never surrender your private keys to the aggregator’s platform. This ensures that the platform cannot confiscate your wallet, a crucial distinction of non-custodial exchanges from custodial exchanges.

Read More: Best Cross-Chain Swap Platforms in 2025: Symbiosis, 1inch, Li.Fi, and Rango

Detailed platform comparison

To choose the best cross chain aggregator 2025, we must look at the giants in the industry. Here is how they stack up against the competition.

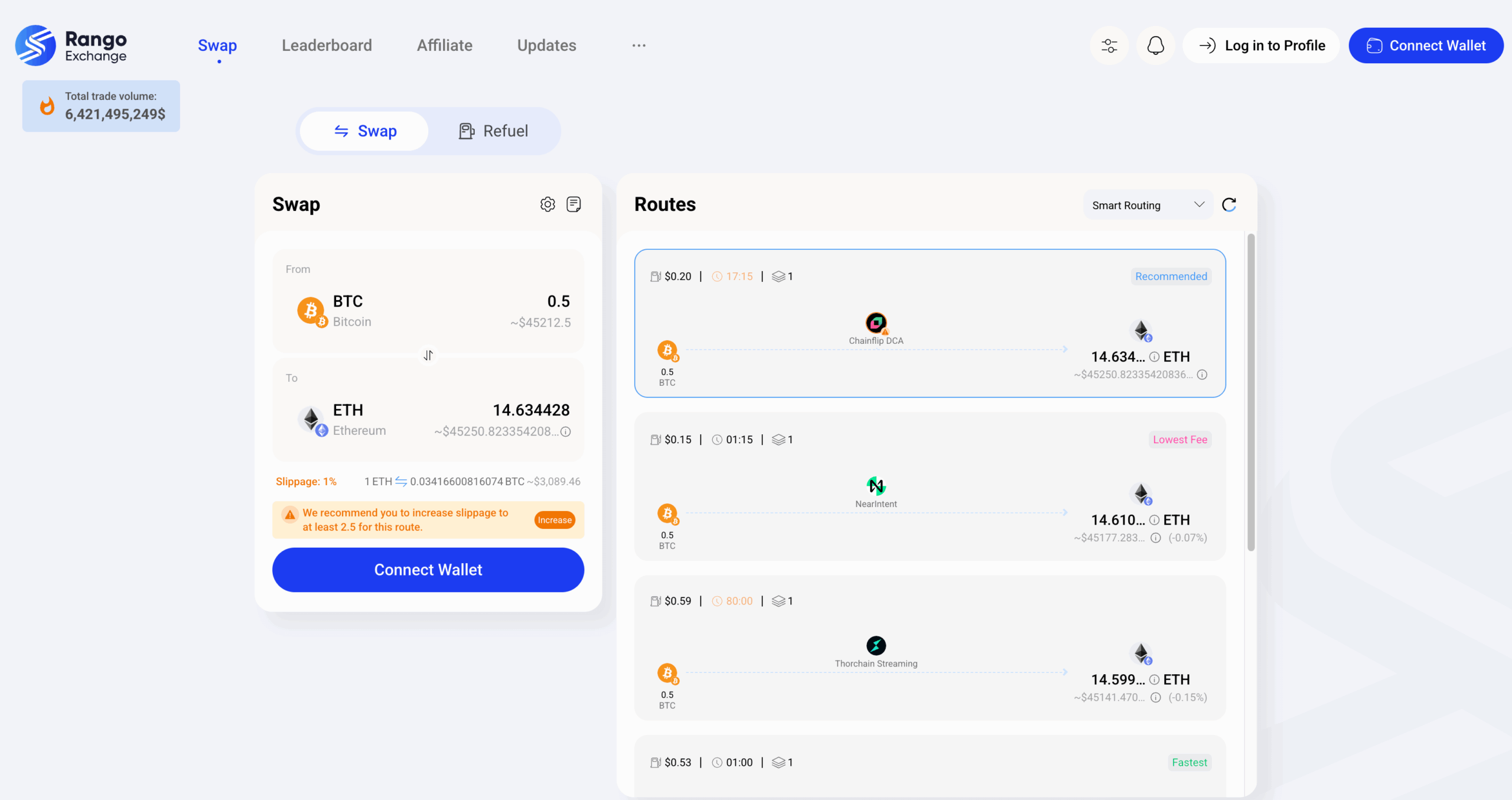

Rango Exchange: The multi-chain veteran

Rango calls itself the “Super App” for cross-chain swaps. It is highly respected for its ability to chain together complex routes. For example, if you need to go from a niche Cosmos chain to a niche EVM chain, Rango will route you through multiple bridges to get there.

- Pros: Massive chain support (77+ blockchains), connects non-EVM and EVM worlds well.

- Cons: Complex multi-step routes can sometimes fail in the middle (creating “dust” on intermediate chains).

- you need to connect yout wallet for the transaction.

Li.Fi: The infrastructure-first solution

Li.Fi is primarily known as a B2B solution, they build the widget that other apps use. However, their own interface, Jumper.exchange, is a powerful tool. Li.Fi excels at aggregating bridges. It treats bridges like DEXs treat liquidity pools.

- Pros: Unparalleled bridge aggregation, great for developers using their SDK.

- Cons: The user interface is functional but lacks the advanced filtering (like specific KYC filtering) that retail traders often need.

- A complex signing in to the platform is required for the transaction.

Flashift: The AI-powered aggregator for privacy & rates

Flashift differs from the competition by focusing on the quality of the exchange service provider. While others focus purely on bridge contracts, Flashift aggregates vetted non-custodial exchange providers and uses an advanced AI engine to evaluate them in real-time.

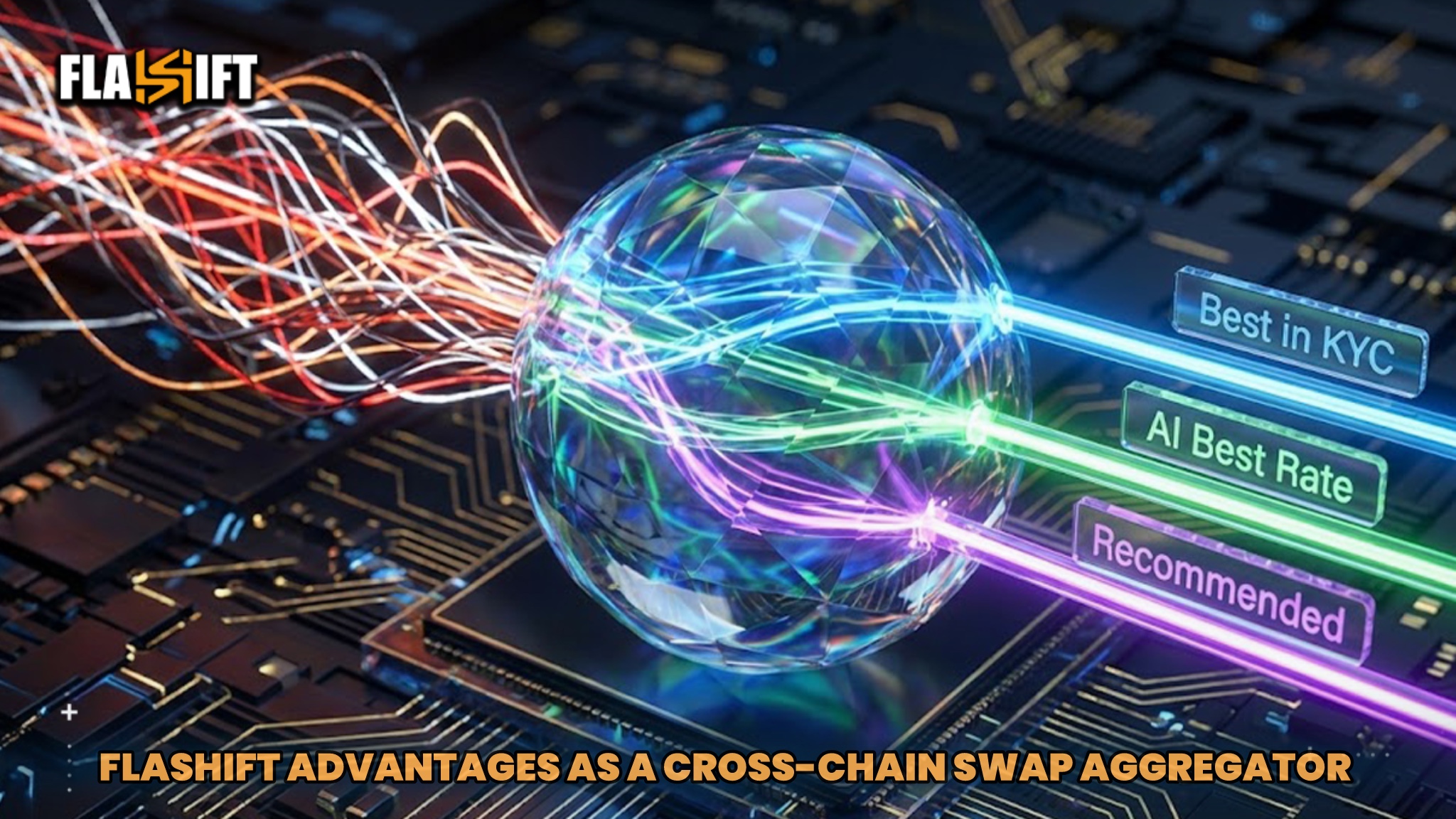

It solves the “Blind Swap” problem. On other platforms, you might click swap and hope the bridge isn’t congested. On Flashift, the system analyzes user feedback, historical success rates, and KYC parameters to assign clear tags:

- Recommended: The perfect balance of speed and rate.

- Best Rate: The absolute highest return mathematically.

- Best in KYC: The route with the lowest verification requirements (privacy-focused).

This makes Flashift the superior choice for users who want to avoid stuck transactions and intrusive data collection while accessing over 3,500 coins.

Feature Matrix of The best aggregators in 2025

| Feature | Flashift | Rango | Li.Fi (Jumper) |

| Primary Focus | User Privacy & Reliability | Complex Multi-chain Routing | Infrastructure & Bridges |

| Token Support | 3,500+ | 3,000+ | 2,500+ |

| Chain Support | Major Chains (inc. BTC/XMR) | 77+ Blockchains | Major EVM + Solana |

| Privacy Focus | High (“Best in KYC” Tag) | Medium | Medium |

| AI Optimization | Yes (Rate & Trust Analysis) | No | No |

| Execution Model | Provider Aggregation | Smart Contract / Bridge | Smart Contract / Bridge |

Read More: Cross-Chain Bridges Explained: How They Work & Which Are Safe

Real-world swap test

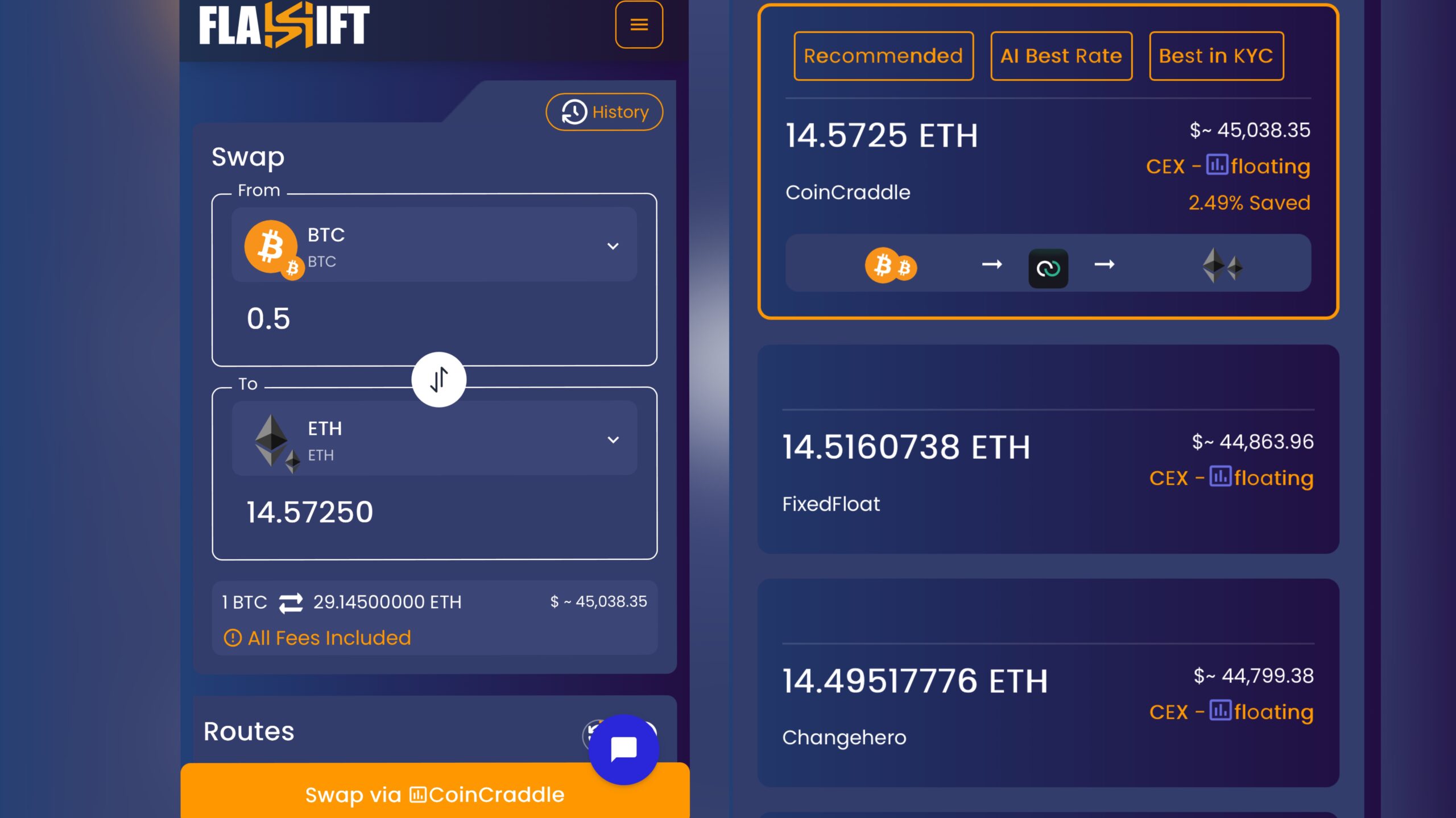

Theory is good, but data is better. To determine the winner of Flashift vs Rango, we conducted a simulated swap test.

The Scenario: Swapping Bitcoin (BTC) to Ethereum (ETH)

This is the “Gold Standard” of cross-chain swaps. Moving liquidity from the Bitcoin network to the Ethereum ecosystem is one of the most requested but technically complex trades due to the lack of native compatibility between the two chains.

-

Input: 0.05 BTC (Bitcoin Network)

-

Target: Native ETH (Ethereum Mainnet)

-

Priority: Maximum received amount + Security (avoiding complex wrapped tokens).

The Results: Speed, Slippage, and Final Received Amount

Note: Market rates fluctuate every second. These results reflect a snapshot taken during standard market hours.

-

Flashift:

Route: Direct Exchange Provider (Identified via AI tags).

Process: Native BTC sent -> Native ETH received.

Time: less than 3 minutes.

Flashift’s AI selected a top-tier provider that handled the conversion without requiring the user to wrap BTC first. The “Recommended” tag ensured we picked a provider with high limits and no hidden spread.

-

Rango:

Route: BTC – ETH.

Process: Often involves intermediate steps or slippage across liquidity pools.

Time: About 2 to 10 minutes.

Rango found a route, but the multi-step decentralized path resulted in slightly higher network fees, reducing the final ETH amount.

-

Li.Fi:

Route: Bridge Aggregation (often via wrapped assets).

Process: Requires connecting a specific wallet compatible with wrapped standards.

While powerful for EVM-to-EVM chains, swapping native Bitcoin is often smoother on an exchange aggregator like Flashift than a bridge aggregator like Li.Fi.

Winner of the Test: Flashift

For a major swap like BTC to ETH, Flashift’s ability to aggregate professional exchange providers resulted in a simpler process and a more competitive final rate, and avoiding the “slippage tax” often found in decentralized liquidity pools for this specific pair. No sign-in required without the task of connecting your wallet.

Flashift advantages

Why did Flashift perform so well in the test? It comes down to three proprietary technologies that set it apart from standard DeFi aggregators.

- Intelligent Tagging: How “AI Best Rate” prevents failed transactions

Most aggregators only show you the mathematical “best price.” But if that price comes from a DEX with low liquidity or a bridge that is currently congested, your transaction will fail, and you may lose gas fees.

Flashift’s AI Best Ratetag analyzes user feedback and historical success rates. It finds the “Sweet Spot”, the rate that is highly competitive but also guaranteed to be accurate and reliable. It prioritizes a predictable exchange experience over a theoretical price that cannot be executed. - Privacy First: Finding the “Best in KYC” routes

This is Flashift’s “Killer Feature.” In 2025, regulatory pressure is high. Many exchange partners now trigger surprise KYC (Know Your Customer) checks on mid-sized transactions.

Flashift is the only aggregator that uses AI to scan providers and tag them as “Best in KYC.”This identifies services with the lowest or most lenient KYC requirements. If you value privacy and want to ensure your swap doesn’t get flagged, this tag allows you to filter specifically for those providers. - Massive Coverage: Accessing 3500+ tokens in one place

While 1inch focuses on ERC-20 tokens and Symbiosis focuses on major caps, Flashift casts a wide net. Covering over 3500 tokens and cryptocurrencies, Flashift allows you to swap niche altcoins directly without needing to bridge to a major chain first. Whether it’s a meme coin, a privacy coin, or a new L2 token, Flashift likely has a route for it.

Start swapping today

The landscape of cross-chain swapping has changed. You no longer need to accept high fees, slow bridges, or privacy invasions.

If you are looking for a best rate, a secure environment, and the ability to filter by KYC level, Flashift is the next-generation tool designed for your needs.

Conclusion

In the battle of Flashift vs Rango vs Li.Fi, there is no single “bad” choice, but there is a clear winner depending on your needs.

- If you are a developer building a DApp, Li.Fi provides the best infrastructure.

- If you are a power user needing to route funds through 77+ different chains, Rango is your tool.

- However, for the vast majority of traders who want the best rate, maximum privacy, and the widest selection of tokens (3500+), Flashift is the superior choice in 2025.

Flashift’s unique integration of AI to filters, transforms a stressful technical process into a simple, predictable, and profitable experience.

FAQs:

- What is the best cross-chain aggregator in 2025?

For user privacy and competitive rates, Flashift is highly recommended due to its AI-driven provider selection. For complex multi-hop routes across dozens of chains, Rango Exchange is also a strong contender. - Which aggregator has the lowest fees?

Fees depend on liquidity and gas costs. However, Flashift’s “Best Rate” tag automatically scans multiple providers to find the option with the lowest total cost (including network fees and slippage) at the moment of the trade. - Do I need to do KYC to use Flashift?

Flashift is a non-custodial aggregator, so you don’t create an account. However, since it aggregates partners, some may have KYC rules. Flashift’s unique “Best in KYC”tag helps users identify exchange partners with the lowest or no KYC requirements, making it ideal for privacy-focused traders. - Is Flashift safe?

Yes. Flashift is non-custodial, meaning it never holds your funds in a centralized Flashift wallet. The swap occurs between you and the vetted exchange provider. You maintain control of your private keys throughout the process. - How does Flashift compare to 1inch?

1inch is primarily a DEX aggregator (great for swapping ETH to other ERC-20 tokens). Flashift is a cross-chain aggregator that excels at moving funds betweendifferent blockchains (e.g., Bitcoin to Ethereum) and supports a wider range of assets (3500+).