Crypto Trading Orders Explained | Most people jump into crypto trading thinking it’s all about timing, but execution is what really separates the amateurs from the traders who actually make money. And that starts with knowing your order types.

Market, limit, stop, and OCO orders aren’t just technical terms. They’re the tools that decide whether you buy high, sell low, or actually get the outcome you were aiming for. If you don’t understand when and why to use each one, the market will take advantage of that.

This guide breaks it down in plain language—no jargon, no hype. Just what each crypto trading order does, when to use it, and how to avoid the mistakes that most new traders make when placing them.

What Are the Different Types of Orders?

Understanding how to enter or exit a trade is more important than most people realize. Price is only half the story (how you execute matters just as much). Below are the key crypto trading orders every serious trader should know.

Market Order

A market order tells the exchange: “Get me in or out now, at the best available price.” It’s instant. No waiting, no conditions. You just hit buy or sell, and it executes immediately using the current order book liquidity.

When to use it:

- You need to enter or exit fast, especially in volatile moments.

- You’re okay with a bit of slippage — small losses from price movement while your order is filling.

The catch? If liquidity is low or you’re trading a large position, you might get filled at worse prices than expected. It’s convenient, but not always precise.

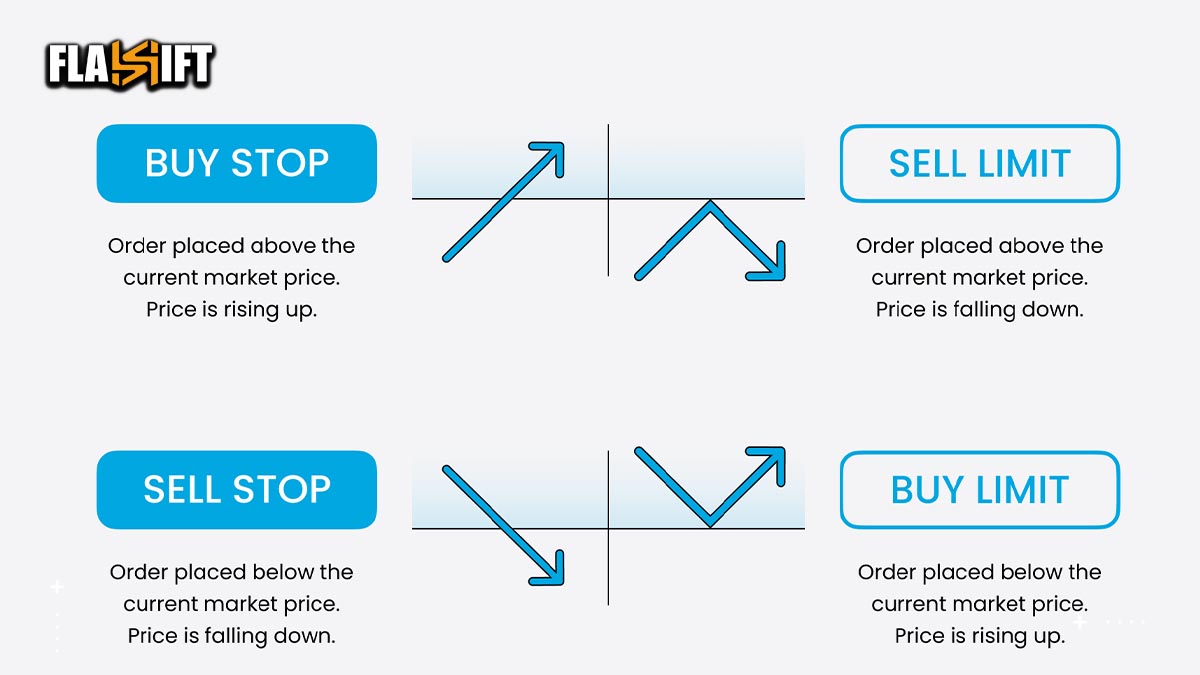

Limit Order

A limit order lets you name your price. You’re saying: “I’ll buy (or sell), but only if the market hits this price or better.” It doesn’t guarantee execution, it only fills if the price reaches your limit.

When to use it:

- You want more control over your entry or exit.

- You’re not in a rush and can wait for the market to come to you.

- You’re setting trap orders above/below key levels.

Example: Bitcoin is trading at $60,000. You place a limit buy at $58,500. It won’t execute unless the price drops to that level.

Limit orders are perfect for strategic entries, but they can leave you on the sidelines if the market never touches your price.

Stop Order (Stop-Loss / Stop-Market)

A stop order is a risk-management tool. It activates a market order once a specific trigger price (the stop price) is hit. It’s often called a stop-loss when used to limit downside, but you can also use it for breakout entries.

When to use it:

- To automatically exit a trade if price moves against you.

- To buy into momentum if price breaks a key level.

- To sleep at night without staring at charts.

Example: You bought ETH at $3,000. To limit losses, you place a stop-market sell at $2,800. If ETH drops to that level, the order fires and sells at market price — whatever that may be.

Keep in mind: in fast crashes, stop orders can execute at worse-than-expected prices due to slippage.

OCO (One Cancels the Other)

OCO orders combine two orders (typically a limit and a stop) and only one can execute. Once one fills, the other is automatically canceled. It’s like setting a take-profit and stop-loss in one shot.

When to use it:

- You want to automate both your exit targets and safety net.

- You can’t monitor the charts constantly.

- You want to avoid emotional exits.

Example: You hold BTC at $58,000. You set an OCO:

- Limit sell at $62,000 (take profit)

- Stop-market sell at $56,500 (cut loss)

If BTC hits $62K, you lock in profit. If it drops to $56.5K, your stop activates. Either way, the other order disappears to prevent accidental double selling.

OCO orders are extremely useful (and underused) by casual traders. If your platform supports them, use them.

Mistakes to Avoid in a Volatile Market

When markets move fast, bad habits get expensive. Knowing your crypto trading orders is important. Using them wrong in high-volatility conditions is where most traders burn capital. Here’s what to avoid when the market gets shaky:

-

Using Market Orders Blindly

In a pump or dump, market orders can slip hard. You think you’re buying BTC at $58K… but low liquidity or bots push you into $59K+. Always check the order book before slamming “buy now.” If precision matters, use a limit order instead.

-

Setting Stop Orders Too Tight

A tiny wick can trigger your stop and leave you watching the market bounce back without you. In volatile conditions, give your stops breathing room—or you’ll get chopped out of every decent setup.

-

Forgetting to Use OCO Orders

Trying to set a manual take-profit and stop-loss is a juggling act you’ll drop eventually. OCO orders automate both sides of your exit strategy. Use them. Especially when you can’t babysit your positions.

-

Placing Limit Orders That Never Fill

Don’t get too cute with sniper entries. If the market doesn’t dip to your limit order, you’ve missed the move. In fast trends, consider laddering your orders or using partial market entries.

-

Ignoring Order Type Behavior During Crashes

In extreme moves, even your stop-loss might not fill at the price you hoped for. That’s not a bug—that’s slippage. Know how your exchange handles crypto trading orders under stress. Read their fine print before it’s too late.

-

Trading Without a Plan, Just an Order Button

No trading order can fix bad strategy. If you’re jumping in just because things are moving, you’re not trading—you’re reacting. Orders are tools, not tactics.

Bottom line

Volatility exposes sloppy execution. Mastering crypto trading orders isn’t about knowing definitions—it’s about using them smartly when the heat turns up. Place your entries with intention. Set your exits like a professional. And don’t let panic touch your keyboard.

How Flashift Fits into the Picture for Execution

Flashift isn’t just another swap tool—it’s built for people who actually care about speed, flexibility, and privacy.

First, it’s fast. Swaps go through in minutes, not hours, whether you’re going from PAXG to USDT or ETH to BTC. And if you’re moving across chains? Flashift acts as a bridge, letting you swap assets between networks (like Ethereum to BNB Chain) without the usual mess of wrapped tokens or multiple steps.

What sets it apart even more is its access to multiple exchange routes behind the scenes. Flashift compares rates across platforms and routes your trade through the most cost-effective path—so you’re not stuck with whatever price a single DEX gives you.

And the best part? No KYC. No account. No email.

Just a clean, anonymous swap—wallet in, wallet out. That’s it.

If you’re looking for a way to manage your trades, profits, or exits without giving up control or identity, Flashift fits right into that workflow.

FAQ

- Why did my stop-loss trigger, but I got a worse price than expected?

That’s slippage. Stop orders become market orders when triggered, and in fast markets, the execution can lag behind the price you set.

- Can I place a limit order that never fills—and still get liquidated?

Yes. If you’re using leverage and your limit order doesn’t fill, price can move against you and trigger liquidation while your order just sits there.

- Is OCO available on every exchange?

No. Some platforms don’t support OCO natively. You’ll need to either set two separate orders manually or use third-party tools to simulate it.

- What happens if I’m offline when my stop order should trigger?

If your stop is already on the exchange, it will still activate. But if it’s only set in your wallet or third-party tool, it won’t trigger unless you’re connected.

- Should I avoid market orders entirely during volatile events?

Not always. Market orders are useful when speed matters more than price—like breakout entries or panic exits. Just be aware of the tradeoff.