Privacy is no longer a luxury; in 2026, it is a survival skill.

With CBDC pilots rolling out across Europe and Asia, the “glass house” economy is here. Every transaction you make on a transparent chain (like Bitcoin) or a centralized exchange is logged, scored, and monitored.

But for every measure of surveillance, there is a counter-measure of sovereignty. Privacy assets are not dead. They just moved underground, and they are stronger than ever.

Here is your tactical guide to the best privacy coins dominating the 2026 landscape and exactly how to acquire them without leaving a digital footprint.

Why Are Privacy Coins Trending in 2026? 🕵️♂️

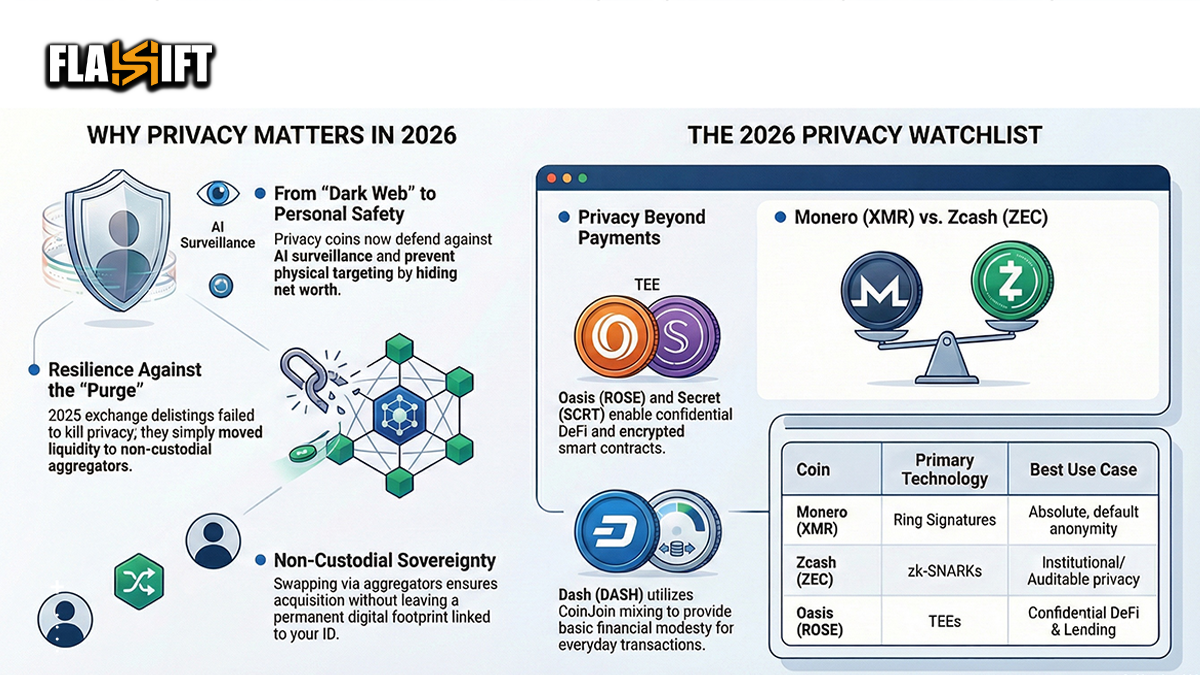

Privacy coins use advanced cryptographic techniques (like Ring Signatures or zk-SNARKs) to obscure transaction details. In 2026, their primary use case has shifted from “Dark Web” payments to “Personal Data Protection” against AI surveillance.

Why is smart money allocating to this sector right now?

- Censorship Resistance: No bank can freeze a Monero wallet.

- Business Confidentiality: Companies use Secret Network to hide supply chain payments from competitors.

- Personal Safety: Hiding net worth to prevent physical targeting.

Performance in 2025: The Year of “The Purge” 📉📈

2025 was a brutal but necessary year for the sector. Centralized Exchanges (CEXs) like Binance and Kraken were forced to delist major privacy coins under regulatory pressure.

The Result?

The weak hands sold, and the die-hard believers accumulated.

While the price of XMR and ZEC dipped initially in 2025, they rebounded violently in Q4 as users realized that DEXs and Aggregators (like Flashift) kept the liquidity alive.

The market learned a valuable lesson: Delisting didn’t kill privacy; it just made it exclusive to non-custodial users.

Top 5 Privacy Coins in 2026 (The Watchlist) 🏆

Here are the projects that have survived the scrutiny and are leading the tech race this year.

-

Monero (XMR) – The Undisputed King 👑

If you want absolute anonymity, there is no second best. Monero is the only coin that is private by default. In 2026, its “Seraphis” upgrade has made transactions faster and even harder to trace.

- Tech: Ring Signatures + Stealth Addresses.

- The Edge: It is fungible. One XMR always equals one XMR (no “tainted” coins).

- Action: Ready to opt out? Swap Monero anonymously on Flashift.

-

Zcash (ZEC) – The Institutional Choice 🛡️

Zcash has made a massive comeback in 2026 by transitioning towards Proof-of-Stake. Its “Shielded Pools” are now easier to use on mobile wallets like Zashi, bridging the gap between compliance and privacy.

- Tech: zk-SNARKs (Zero-Knowledge Proofs).

- The Edge: Optional privacy. You can share a “View Key” with an auditor if needed.

Action: Join the shielded pool. Swap Zcash anonymously today.

-

Oasis Network (ROSE) – Privacy for DeFi

Privacy isn’t just about payments; it’s about smart contracts. Oasis allows developers to build “Confidential DeFi” apps where the user’s data isn’t exposed on-chain.

- Tech: Trusted Execution Environments (TEEs).

- The Edge: It enables private lending and under-collateralized loans.

- Action: Swap ROSE anonymously to enter the confidential Web3 era.

-

Dash (DASH) – Speed Meets Privacy ⚡

Dash focuses on usability. It isn’t as paranoid as Monero, but its “PrivateSend” feature (CoinJoin) is perfect for everyday transactions where you just want basic financial modesty.

- Tech: CoinJoin mixing.

- The Edge: InstantSend locks transactions in under 2 seconds.

- Action: Swap DASH anonymously for fast, private payments.

-

Secret Network (SCRT) – The Private Ethereum 👁️

Secret Network brings privacy to the application layer. In 2026, it is the backbone for “Private Voting” in DAOs and encrypted NFTs.

- Tech: Encrypted Smart Contracts.

- The Edge: Keeps the input and output of a contract hidden from public view.

- Action: Swap SCRT anonymously to use dApps without doxxing yourself.

How to Swap Privacy Coins Without KYC 🔄

The best method to acquire privacy coins in 2026 is via Non-Custodial Aggregators. Platforms like Flashift route trades across 15+ exchanges to find the best rate while requiring zero personal data.

If you buy Monero on a centralized exchange (if you can even find one), you leave a permanent record that links your ID to that privacy coin. That defeats the purpose.

The Flashift Workflow:

- Select: Choose your input (e.g., USDT, BTC) and your target (XMR, ZEC).

- Analyze: Our AI scans the market for the “Best Rate.”

- Swap: Send your deposit. The system swaps it and sends the privacy coin straight to your personal wallet.

Conclusion: Privacy is a Right, Not a Crime 🏁

The narrative that “only criminals use privacy coins” died in 2025. Today, privacy is for anyone who doesn’t want their salary, spending habits, or net worth broadcast to the world.

The privacy coins 2026 landscape is robust, battle-tested, and ready for adoption.

Don’t let the surveillance state win.

Own your data. Own your money.

FAQ

- Is it legal to buy Monero in 2026?

Yes. Holding and trading Monero is legal in most jurisdictions for individuals. The restrictions usually apply to centralized exchanges listing it, which is why non-custodial aggregators are the preferred method for acquisition.

2. Which is better: Monero or Zcash?

It depends on your goal. For absolute, default privacy, Monero (XMR) is superior. For speed and optional transparency (e.g., for tax purposes), Zcash (ZEC) is often preferred.

3. Can I swap BTC for XMR without an account?

Absolutely. Flashift specializes in cross-chain swaps like BTC to XMR without requiring sign-ups or identity verification.