- What Is Chainlink (LINK)?

- Why LINK Has Become a Strategic Asset in 2025

- Best Exchanges to Buy LINK in 2025: Fees, Liquidity, Payment Methods & More

- Step-by-Step Guide to Buying LINK using the Flashift.app

- When NOT to Buy LINK (Situations to Avoid as a Smart Investor)

- Best Wallets to Store Chainlink Securely

- Security Tips for Holding LINK

- Final Thoughts

- FAQ

With the crypto market’s development, Chainlink (LINK) continues to be among the most valued and well-established blockchain initiatives—connecting smart contracts to trusted real-world data. You’re a longtime holder of decentralized tech or are simply adding cryptocurrency diversification if you’re ever going to take the necessary precautions to discover the best ways to buy LINK in 2025 and to store Chainlink tokens properly.

In this guide, we’ll walk you through everything you need to know—from the best platforms to buy LINK to choosing a secure LINK wallet to pro tips for keeping your assets protected from hacks and scams. Whether you are a beginner or an experienced investor, this article gives you a clear, step-by-step roadmap for safely managing your LINK holdings in 2025 and beyond.

What Is Chainlink (LINK)?

Chainlink (Link) is a decentralized Oracle network that enables smart contracts on blockchain to securely interact with real-world data, APIs, and external systems. Blockchain, by design, cannot reach off-chain information, which limits the usefulness of smart contracts in many practical applications.

Chanlink solve this problem by providing a safe bridge for the on-chain smart contracts to the external data (e.g., weather, stock prices, and payment confirmation). This setup allows developers to manufacture decentralized applications (dApps) that are far more intelligent, responsible, and useful in real-world scenarios.

The LINK tokens forward the Chainlink ecosystem by rewarding node operators to provide accurate and reliable data. Unlike centralized oracles, Chainlink uses a decentralized network of nodes to eliminate single points of failure and reduce the risk of data manipulation.

Chainlink is already integrated with major blockchains such as Ethereum, Polygon, and BSC and has earned its place in decentralized finance (DeFi), insurance, gaming, and supply chains. As blockchain technology develops, Chainlink will become an essential infrastructure that brings real-world connectivity to smart contracts.

Why LINK Has Become a Strategic Asset in 2025

Chainlink is no longer just an oracle project. In 2025, it has become a critical coordination layer for real-world assets, institutional DeFi, and cross-chain security. Large financial players are increasingly using Chainlink’s CCIP (Cross-Chain Interoperability Protocol) to move tokenized assets between blockchains, and this shift has quietly transformed LINK from a speculative token into a utility coin that powers high-value transactions.

As more banks, exchanges, and enterprise systems integrate Chainlink’s data feeds and messaging infrastructure, demand for LINK grows naturally because the token is required for network operations. This is why many investors now view LINK as a strategic long-term hold, not just another crypto asset to trade, but a gateway to the emerging economy of tokenized real-world assets. The key difference in 2025 is that Chainlink’s adoption is no longer theoretical; it’s actively shaping how major institutions move data and value across chains.

Best Exchanges to Buy LINK in 2025: Fees, Liquidity, Payment Methods & More

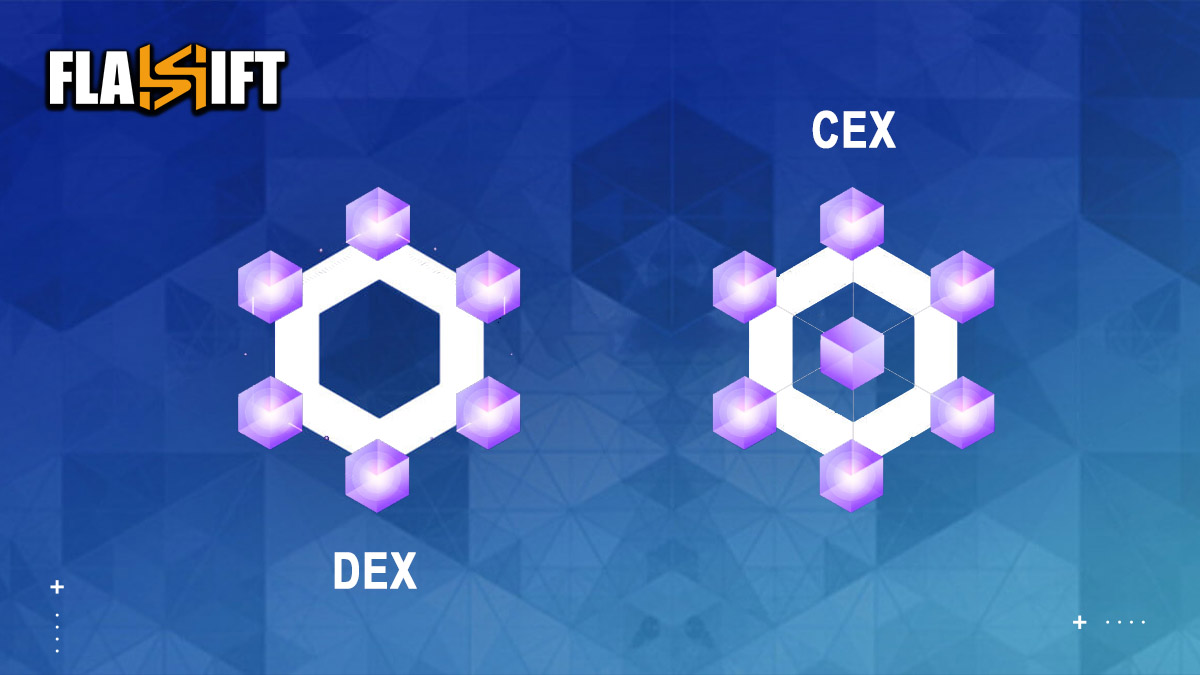

Centralized Exchanges

Centralized exchanges (CEXs) are, to this day, one of the easiest and most accessible ways to buy LINK in 2025, especially for beginners. CEXs are user-friendly and well-liquidated, and they accept various payment options like credit/debit cards, bank transfers, and other cryptocurrencies. Some of the safest CEXs through which you can buy LINK are:

- Binance: Offers low trading fees, advanced trading features, and global availability.

- Coinbase: Ideal for beginners, especially in the U.S., with simple buying options.

- Kraken: Known for strong security, regulatory compliance, and fiat deposit options.

- Bybit and OKX: Popular among experienced traders for competitive fees and bonus programs.

Before choosing an exchange, consider regional availability, KYC requirements, and trading fees. Always withdraw your tokens to a secure LINK wallet to maintain complete control over your assets after purchase.

At a Glance: Best Exchanges to Buy ChainLink

| Exchange | Best For | LINK Trading Pairs | Fees (Spot) | KYC Required | Payment Methods | Pros | Cons |

| Binance | Lowest fees & global liquidity | LINK/USDT, LINK/BTC, LINK/FDUSD, LINK/TRY | 0.1% maker / 0.1% taker | Yes (most regions) | Bank transfer, card, P2P | Largest LINK liquidity, advanced trading tools, strong security | Restricted in some countries |

| Coinbase | Beginners & U.S. users | LINK/USD, LINK/EUR, LINK/USDT | 0.4%+ (varies) | Yes | Bank transfer, card, PayPal | Very easy UI, regulated, secure | Higher fees, fewer trading pairs |

| OKX | Active traders & global access | LINK/USDT, LINK/BTC, LINK/ETH | 0.08% / 0.10% | Partial KYC | Bank transfer, card, P2P | Low fees, strong liquidity, good derivatives market | Limited service in U.S. |

| Bybit | Derivatives traders & low-fee spot | LINK/USDT, LINK/BTC | 0.1% / 0.1% | Partial KYC | Card, bank transfer, P2P | Very low fees, strong futures market | Not available in some restricted regions |

| Kraken | Safety-focused users | LINK/USD, LINK/EUR, LINK/GBP | 0.16% / 0.26% | Yes | Bank transfer, card | Highly trusted, strong compliance | Higher fees, fewer fiat options |

Decentralized Exchanges

For those who prefer a more private and non-custodial approach, decentralized exchanges (DEXs) offer a powerful alternative. DEXs let you trade directly from your crypto wallet without relying on an intermediary. In 2025, the top platforms where you can buy Chainlink include:

- Uniswap (Ethereum-based) – One of the most trusted DEXs for ERC-20 tokens like LINK.

- SushiSwap – Supports multiple chains and offers staking options.

- 1inch – A DEX aggregator that finds the best prices across multiple platforms.

- PancakeSwap – Suitable for trading wrapped LINK on BNB Chain.

Using a DEX requires a compatible wallet like MetaMask, some ETH or BNB to cover gas fees, and familiarity with transaction approvals. While less beginner-friendly, DEXs give you full custody of your funds and greater privacy.

The Best Platform to Buy LINK in 2025

If you are looking for the easiest and most secure way to buy LINK in 2025, the Flashift.app is among the top platforms you can use. Flashift is a quick, friendly website where you can immediately buy Chainlink (LINK) without registration and with full non-custodial ownership. It’s ideal for beginners and seasoned veterans who prefer convenience and anonymity.

With multi-blockchain support and expanding payment lists, Flashift provides quick, secure swaps at competitive rates. From purchasing LINK with ETH, USDT, or other mainstream cryptos, the platform makes seamless execution and total transparency a priority—ideal for users seeking to bypass the intricacies of typical exchanges.

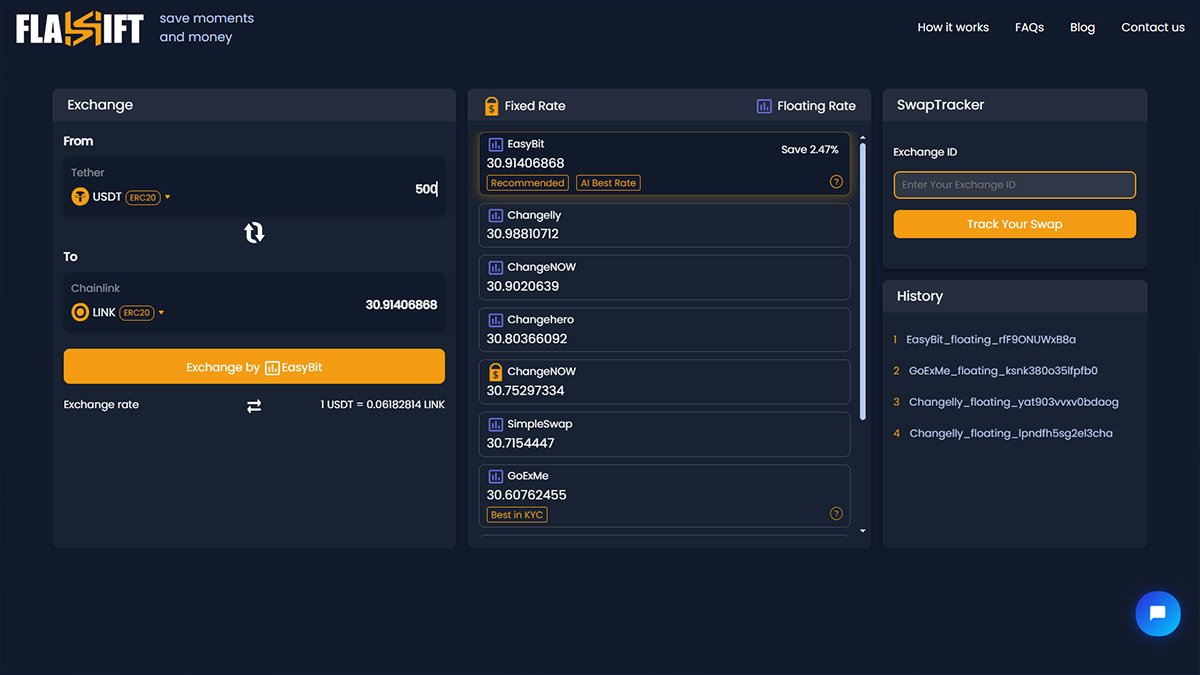

Step-by-Step Guide to Buying LINK using the Flashift.app

If you’re ready to add Chainlink (LINK) to your crypto portfolio in 2025, here’s a simple, step-by-step process inspired by the fast and user-friendly experience on Flashift.app—a top platform for buying LINK without the hassle of sign-ups or KYC.

Step 1: Visit Flashift.app

Go to Flashift.app on your browser; then click “Lunch App”. (or use this link: exchange.flashift.app)

Step 2: Select the Assets You Want to Swap

In the “From” field, choose the cryptocurrency you want to swap from (e.g., ETH, USDT, BTC).

In the “To” field, select LINK as the asset you want to receive.

Flashift automatically finds the best rate across multiple liquidity sources to ensure a fast and cost-efficient trade. After choosing the exchange, click “Exchange By…“.

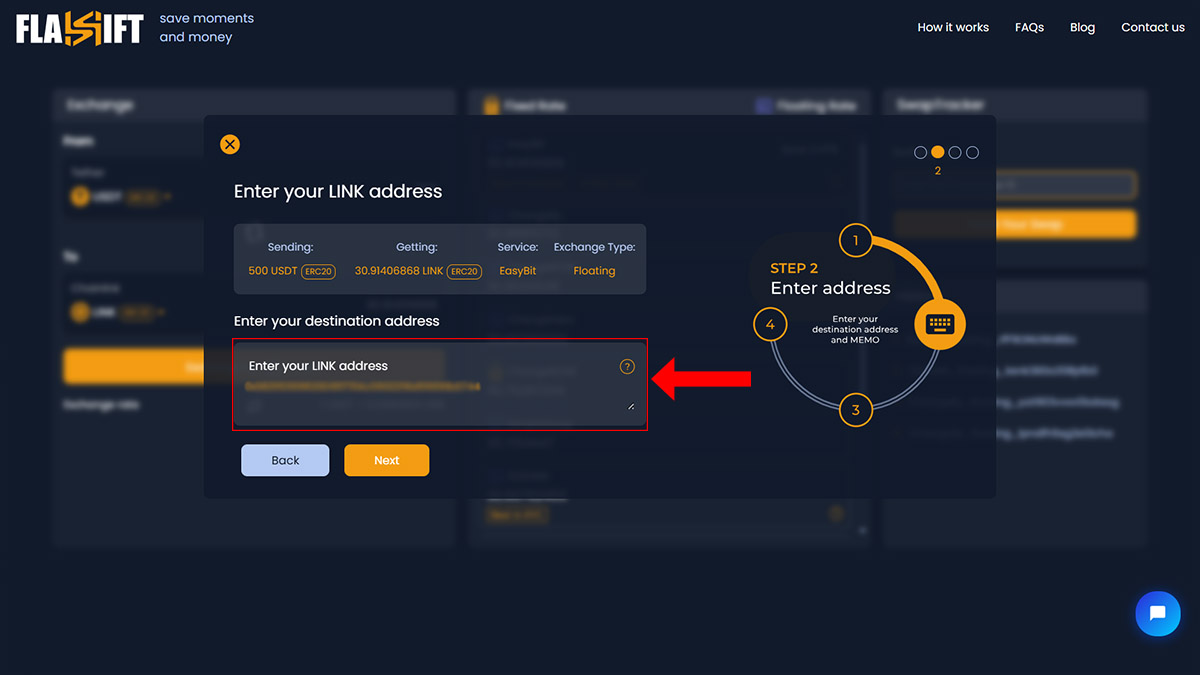

Step 3: Enter Your Wallet Address

Paste your personal wallet address where you want to receive your LINK tokens. Flashift is fully non-custodial, meaning it never holds your funds or keys.

Tip: For better protection, use a secure wallet like MetaMask, Trust Wallet (Recommended), or a hardware wallet (more on this later).

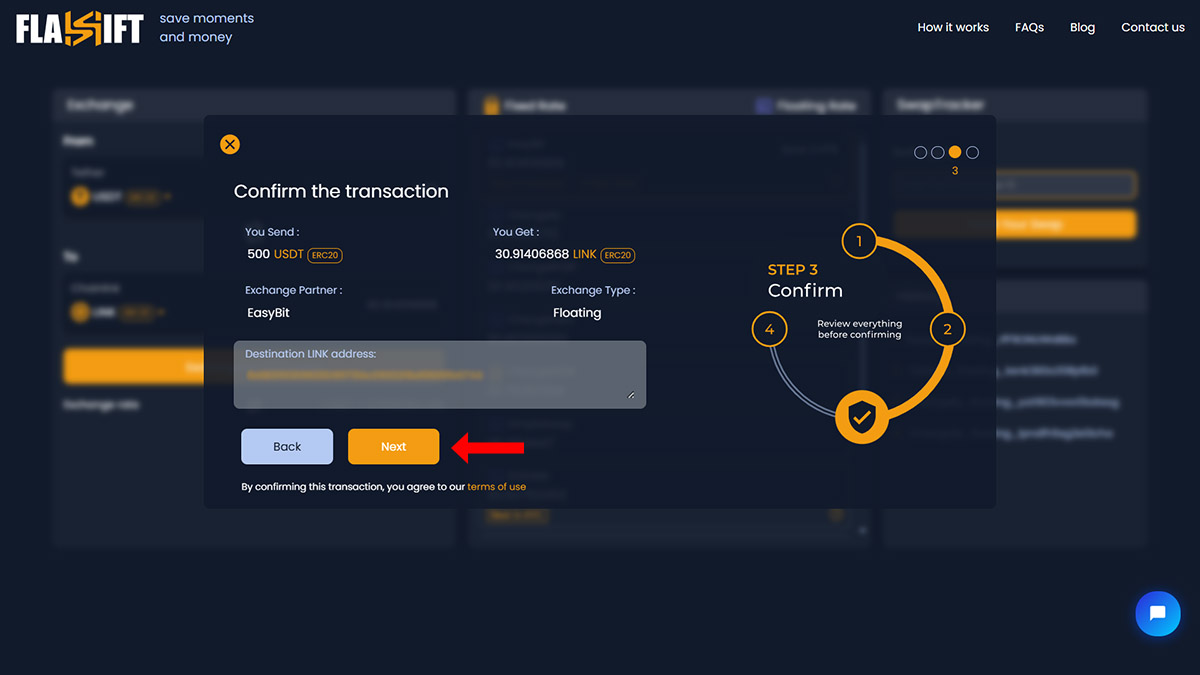

Step 4: Confirm the Swap

Review the details of your transaction, including the exchange rate, network fee, and expected LINK amount. Once you’re satisfied, click “Next”.

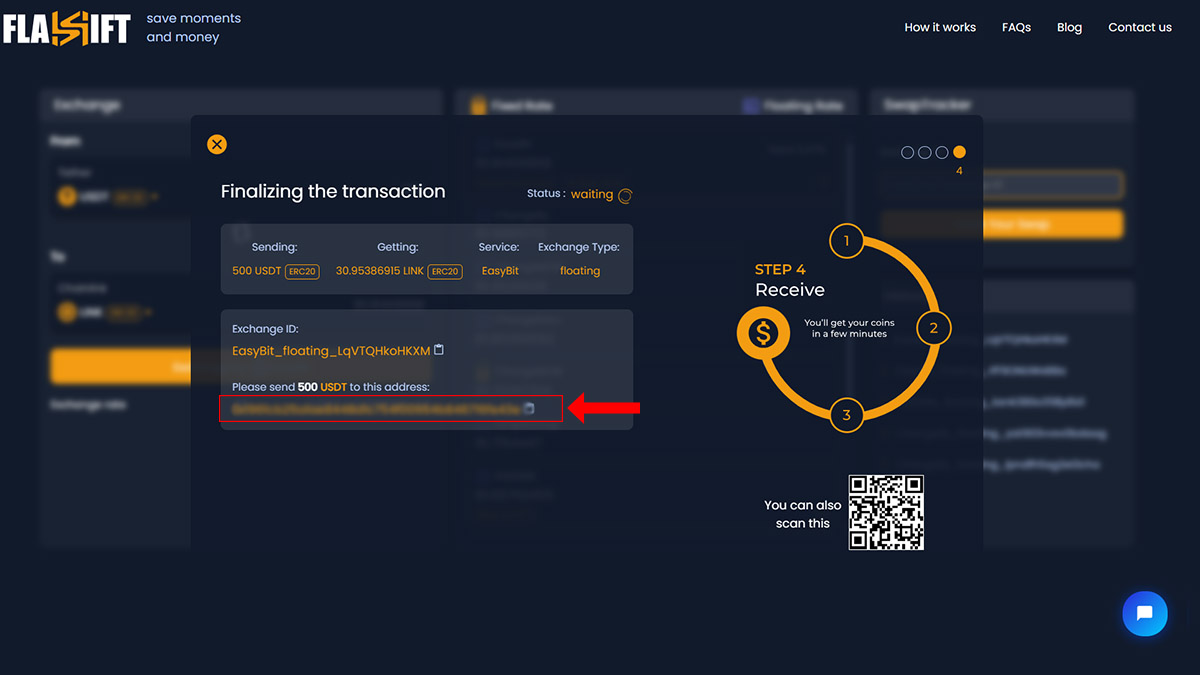

Step 5: Send Your Funds

Send the exact amount of the selected crypto (We’ve selected USDT) to the address provided. Once your transaction is confirmed on the blockchain, the swap will begin automatically.

Step 6: Receive LINK tokens in Your Wallet

After the transaction is processed, your LINK tokens will be delivered directly to your wallet—fast, secure, and without any third-party holding your funds.

Flashift.app makes buying Chainlink in 2025 as easy as a few clicks—there is no sign-up, KYC, or complications. It is perfect for users who value speed, privacy, and control.

Try Flashift.app and Swap your Crypto for $LINK

When NOT to Buy LINK (Situations to Avoid as a Smart Investor)

Buying Chainlink (LINK) at the wrong time can lead to unnecessary short-term losses — even if you’re bullish long-term. LINK is known for sharp volatility around key announcements and market events, so timing matters more than most beginners realize. Below are the specific situations when you should avoid buying LINK, based on historical market behavior and real trading patterns.

- Avoid Buying During Hype Spikes After Major Announcements

LINK often rallies quickly after big news such as:

- Oracle integrations

- Chainlink partnerships

- CCIP (Cross-Chain Interoperability Protocol) updates

- Major DeFi protocol announcements

Historically, LINK experiences a “hype spike” followed by a 5–15% correction within 48–72 hours, as excitement cools and short-term traders take profit. Wait for the post-announcement pullback instead of chasing green candles.

- Avoid Buying LINK When Bitcoin Is Dropping Fast

Even though LINK sometimes decouples, 90% of LINK’s major pullbacks follow sudden Bitcoin drops.

Situations to avoid:

- BTC falling >3% in an hour

- BTC breaking major support

- High fear index conditions

In these scenarios, LINK rarely holds its price and usually gives a cheaper entry later. Wait for BTC to stabilize before entering LINK.

- Avoid Buying LINK Right After a Parabolic Run

If LINK has already pumped 20–40% in a short period, it becomes extremely risky to buy immediately afterward. High funding rates, overbought RSI, whale distribution, traders waiting to short the top, are the common reasons to avoid buying LINK. This is when inexperienced buyers get trapped. Look for consolidation or a healthy retracement before entering.

- Avoid Buying LINK During Low-Liquidity Hours

LINK liquidity drops significantly:

- Late weekends

- Major holidays

- Overnight hours in US + EU markets

Low liquidity = higher volatility = worse fills. This can cause slippage on market orders, fake breakouts and, stop-loss hunting. Trade during high-volume periods (London + New York trading sessions).

- Avoid Buying LINK When Gas Fees Are Extremely High

If you are buying LINK on Ethereum (or withdrawing to an ETH wallet), high gas fees can add $10–$40 of unnecessary cost to your transaction.

This is especially problematic for:

- Small purchases

- Frequent DCA buyers

- Wallet-to-wallet transfers

Check gas fees on Etherscan — if above 80–100 gwei, wait or use a cheaper chain like Arbitrum.

- Avoid Buying LINK Based on Social Media Hype

When X (Twitter), TikTok, or Telegram becomes overly bullish on LINK, it often means:

- Retail FOMO is peaking

- Whales are distributing

- Influencers are pushing sponsored content

At these moments, the price is usually inflated. Look at on-chain data and volume instead of opinions.

- Avoid Buying LINK If You Don’t Have a Wallet Ready

A common mistake is people buy LINK before preparing secure storage. If the exchange freezes withdrawals or goes down temporarily, your funds are stuck. So, Set up a wallet (Ledger, MetaMask, Trust Wallet) before buying.

Note: The best investors don’t just decide what to buy, they decide when NOT to buy. For LINK, avoiding hype-driven tops and volatile market conditions is one of the simplest ways to improve your long-term performance.

Best Wallets to Store Chainlink Securely

Once you have bought Chainlink (LINK), securing it becomes a top priority. As an active trader or a long-term holder, a good LINK wallet will secure your funds from theft and hacking. Below is a summary of the best software and hardware wallets to ensure your LINK is safe.

Hardware Wallets

For maximum security, hardware wallets are the best option. These physical devices store your private keys offline, keeping them safe from online threats such as phishing and hacking attempts. Hardware wallets are ideal for long-term storage or holding larger amounts of LINK.

- Ledger Nano X / S Plus – One of the most popular hardware wallets for crypto enthusiasts, the Ledger series supports Chainlink and hundreds of other tokens. It’s compact, easy to use, and features robust security with PIN protection and a recovery phrase.

- Trezor Model T – Another reliable hardware wallet offering strong security features. It supports LINK and many other tokens and includes a touchscreen for easy interaction. Trezor’s open-source firmware also makes it a favorite among security-conscious users.

Tip: Always keep your recovery seed in a safe, offline location, such as a safe deposit box. Never share it with anyone.

Software Wallets

Software wallets are ideal for users who want easy access to LINK tokens while maintaining security. These wallets are typically apps or browser extensions that store your private keys on your device.

- MetaMask – One of the most popular browser-based wallets that supports Ethereum and ERC-20 tokens like LINK. It’s easy to set up and use for interacting with decentralized applications (dApps) and exchanges.

- Trust Wallet – A mobile-friendly software wallet that supports Ethereum-based and Binance Smart Chain tokens, including LINK. Trust Wallet also allows you to stake your LINK and other tokens directly from the app.

- Exodus – A desktop and mobile wallet that supports a wide range of cryptocurrencies, including LINK. It features an integrated exchange for swapping tokens and allows for seamless asset management.

Tip: While software wallets are more convenient, they are less secure than hardware wallets. Always back up your private keys and be cautious when interacting with untrusted websites.

Read More: The most secure crypto wallets

Security Tips for Holding LINK

- Use Multi-Signature Wallets

Enhance security by using a multi-signature wallet. This wallet requires multiple keys to authorize transactions, reducing the risk of single-point failures.

- Enable Hardware Wallet Passphrases

Enabling a passphrase on your hardware wallet will add an extra layer of protection, making it harder for thieves to access your LINK.

- Separate Storage for Holdings

Distribute your LINK across multiple wallets. To minimize risk, use a hardware wallet for long-term storage and a software wallet for daily transactions.

- Review Active Connections

Regularly revoke access to dApps or platforms you no longer use to prevent unauthorized access to your LINK holdings.

- Use Privacy-Focused Exchange Services

Opt for decentralized exchanges (DEXs) or crypto aggregator platforms like Flashift.app to avoid sharing personal data and enhance privacy when buying or transferring LINK.

- Be Cautious of Phishing Scams

Avoid phishing attacks by never clicking on suspicious links and checking URLs to ensure they’re legitimate before entering sensitive information.

Final Thoughts

In 2025, it will be simpler than ever to buy and securely store Chainlink (LINK), thanks to many safe platforms and wallets. Whether you acquire LINK on centralized exchanges or through decentralized platforms, always keep security in mind. Using hardware wallets for safe long-term storage and multi-signature wallets for additional protection, you can protect your LINK tokens from hackers and attempted theft.

Remember that the crypto world continues to change, and you must stay updated with new security tools and technologies. Following the steps in this guide, you can invest in Chainlink and store LINK safely, ensuring your money is adequately protected in 2025 and later.

FAQ

- Can I buy LINK without providing my personal details?

Yes, you can buy LINK on platforms like the Flashift.app without registration or KYC. It’s a non-custodial, privacy-focused crypto swap aggregator.

- Is it safe to store LINK in a software wallet like MetaMask?

While software wallets are convenient, they’re more vulnerable to hacking than hardware wallets. For added security, consider using two-factor authentication (2FA) and never share your private keys.

- Should I store all my LINK tokens in a single wallet?

No, it’s better to spread your LINK across multiple wallets—keep a small amount in a software wallet for easy access, and store the majority in a hardware wallet for long-term security.

- How do I know if a platform to buy LINK is secure?

Look for features like SSL encryption, user reviews, and two-factor authentication (2FA). Reputable platforms like the Flashift.app have no hidden fees and prioritize privacy and security.

- Can I use LINK in DeFi applications right after buying it?

Yes. Once you purchase LINK and store it in a compatible wallet, you can use it in DeFi apps for lending, staking, and interacting with smart contracts on platforms like Uniswap or Aave.