Decentralized finance, or DeFi, will replace the current financial system in the future. Through DeFi, we become familiar with digital currencies. Decentralization is one of the distinctive features that sets apart traditional financial markets. By “decentralized,” we mean the control and decision-making regarding money (in the entire financial system) of a country by specific authorities and central banks (certain individuals and groups). In other words, financial flows of a country are centrally controlled by government and political authorities; decisions regarding currency printing, money flow, and supply are all in their hands. With the emergence of concepts like DeFi, this method of management will gradually change.

Reasons for the Emergence of DeFi System

Within the current dominant traditional financial system worldwide, people entrust their assets to institutions such as banks to generate profits. These institutions still operate at the upper echelons, under government control and, in essence, are governed by specific individuals. The problem with such a system lies in the centralized control by specific and identifiable individuals, greatly increasing the risks associated with it. One alternative solution that addresses the shortcomings of the traditional financial system is the decentralized financial system, or DeFi, built on the Ethereum blockchain for trading digital currencies and other financial activities. How will this concept impact the blockchain and digital currency space?

If you are skeptical about the idea of a “decentralized financial system” and believe that solutions like DeFi are doomed to fail, consider the following example. Imagine the central controlling entities of a country’s financial system, with the misguided strategy of overcoming a financial crisis, opting for reckless and unsupported currency printing. The decision-makers may be aware or unaware of the consequences of their actions. However, the outcome could resemble the catastrophic economic situation in Venezuela. When high-ranking officials in Venezuela, faced with a sharp drop in oil prices and severe U.S. sanctions, decided to print and inject currency recklessly, the result was an annual inflation rate of 1 million percent. The concept of DeFi prevents such incidents from occurring.

Introduction to DeFi

The capability of blockchain technology to disrupt the current global economic system is undeniable. Over the past decade, especially in recent years, significant strides have been made in this direction, leading to a vibrant cryptocurrency market. In this market, coins like Bitcoin and Ethereum reign supreme.

While significant progress has been made in the development and widespread adoption of cryptocurrencies and blockchain technology in recent years, the actual trend toward adopting a truly decentralized economy is still in its infancy. We expect the benefits of cryptocurrencies and blockchain technology to showcase themselves on a broader scale in the world’s economic system, but significant achievements in this regard have not been realized yet. DeFi has emerged to expedite this process.

Digital currencies, a useful but insufficient solution for decentralizing financial systems

Currently, you can buy digital currencies, invest in this area, and exchange cryptocurrencies securely without the need for intermediaries like a bank. However, we still have a long way to go for widespread support of cryptocurrencies. Even in a country like Turkey, where a larger portion of the population has accepted cryptocurrencies as a strong-backed asset and a viable payment method compared to other countries, only about 20% of people have been using digital currencies from the past to the present. Thanks to DeFi, this situation will soon change.

Buying Bitcoin and other digital currencies in a completely secure manner without the need for intermediaries allows individuals to have full control over their assets. The point here is that despite the widespread popularity of cryptocurrencies among people and improved perceptions of governments towards them, digital currencies have not yet succeeded in decentralizing the traditional financial system. We are at the beginning of the path of decentralizing these systems through DeFi and similar solutions.

You might think that with a little patience, the situation will improve soon. While this assumption is not entirely wrong, global acceptance of encrypted digital currencies still has a long way to go before it fulfills the promise of a “complete economic revolution.” Yes, local currencies may replace global encrypted coins in the future, but our perspective is a deeper look into the concept of decentralization. Through this, we will reach DeFi or decentralized financial system, where the fundamental blockchain concept is applied to almost all financial matters and is not limited to buying and selling cryptocurrencies.

What is DeFi and how was it created?

The term DeFi stands for Decentralized Finance, referring to a decentralized financial system. This platform includes digital assets, protocols, smart contracts, and decentralized software built on the blockchain. Ethereum is currently the best option for implementing DeFi due to its flexibility and advanced development capabilities. However, Ethereum is not the only blockchain platform capable of implementing DeFi.

To enhance comprehension, envisage DeFi as a sprawling financial ecosystem, wherein an array of financial tools and services can be crafted in a decentralized fashion atop the blockchain platform. Operating within the confines of Blockchain, this program affords seamless amalgamation, modification, and integration of services, akin to the assembly of a sophisticated Lego set. At present, the Ethereum blockchain serves as a host to captivating programs, encompassing a decentralized banking system, a decentralized payment system, a decentralized lending system, and an intricate web of interconnected applications.

Professor Philipp Sandner, an erudite economist and fervent IT industry enthusiast, articulates the essence of DeFi thus:

DeFi epitomizes an intricate ecosystem comprising applications meticulously erected upon publicity distributed ledgers (blockchain), orchestrating the facilitation of permissionless financial services.

The term “permissionless” denotes protocols or blockchains that dispense with the prerequisite of authorization for membership, usage, and interaction, thereby embodying the nomenclature of public blockchains. Ponder upon the simplicity of executing DeFi transactions or merely acquiring and retaining a cryptocurrency through the utilization of a digital currency wallet. Merely download and install a mobile application, and voila! This streamlined process stands in stark contrast to the convoluted endeavor of establishing a new bank account, thereby casting a luminous spotlight upon the subject matter.

The most secure crypto wallets

The decentralized financial system extrapolates the paradigm of employing a decentralized ledger or blockchain to encompass the entirety of financial affairs, transcending the boundaries of cryptocurrencies. Within the realm of DeFi, blockchain transcends its conventional role in mere transactions; it becomes the bedrock for managing savings accounts, offering loans, orchestrating investments, facilitating trade, procuring insurance, and virtually every financial pursuit entwined with institutional financial entities.

The Imperative Role of Smart Contracts in DeFi

In elementary terms, DeFi signifies a financial milieu executed upon a peer-to-peer network, leveraging a plethora of decentralized applications. The efficacy of this system hinges upon the indispensable presence of smart contracts.

Smart contracts, as sophisticated programs or protocols, execute, govern, or document contracts, agreements, or negotiations. Engagement with a smart contract within DeFi or any analogous system necessitates the affirmative concurrence with explicitly delineated terms and conditions, analogous to the establishment of a contract in the tangible realm. The brilliance inherent in these contracts on the blockchain lies in their capacity to scrutinize and ensure the realization of conditions preordained by the contract’s progenitor. Consequently, activities such as depositing cryptocurrency into an account or procuring insurance seamlessly transition into fully automated processes.

Contemplate a scenario where a corporate entity opts to delegate the issuance of insurance to smart contracts, expediting bureaucratic processes. Upon a customer remitting a stipulated sum alongside the requisite information (contract conditions), the issuance of an insurance policy becomes an automatic undertaking. The entirely automated and autonomous issuance of insurance policies merely scratches the surface of the multifaceted applications inherent in DeFi, courtesy of decentralized applications and the ingenuity of smart contracts.

Using DApps

In the convoluted labyrinth of user entanglement with DeFi decentralized applications (DApps), a symphony of intricacy and innovation unfurls its arcane notes. DeFi, in its relentless pursuit of objectives, deftly wields the latent power of decentralized applications, meticulously woven in the intricate loom of a decentralization-drenched environment—specifically, within the labyrinthine folds of a peer-to-peer (P2P) blockchain ecosystem. This idiosyncratic attribute endows them with an impervious veneer against the authoritative clutches of any singular organization, institution, or company. Thus, the omnipotent grasp of governments and regulatory entities stumbles in its endeavor to exert control, for there exists no singular centralized entity accountable for these DApps—entities immune to the pressures of modification or, in the extreme, obliteration.

The enigmatic choreography between smart contracts and decentralized applications beckons the probing gaze of scrutiny. Are they disparate entities, aloof and disconnected? It is paramount to acknowledge that direct engagement with smart contracts remains a cryptic odyssey for the uninitiated user. Envision a tableau where the mastery of sophisticated programming becomes an inevitable prerequisite, merely to navigate the Byzantine corridors of a DeFi platform in pursuit of securing a loan! Decentralized applications, thus, emerge as the indispensable conduit, presenting users with a user-friendly interface—an intuitive canvas for seamless visual interaction.

A DApp, an ephemeral enigma, spurns the shackles of a centralized server, opting instead for a distributed existence across a network intricately woven with myriad devices—nodes or peers. This ethereal dance with decentralization imparts an elusive quality, aptly christened a decentralized application. The core tenet of openness pervades DApps, gracefully extending their tentacles globally through the vast expanse of the internet. The very essence of permissionlessness, elucidated by the erudite Professor Philipp Sandner, emanates from this intrinsic characteristic—an ethereal quality where anyone, unencumbered by constraints, partakes in the utilization and interaction with decentralized applications, effortlessly crafting bespoke entities to align with their unique objectives. The advent of platforms such as Ethereum and Cardano has ushered in an epoch where the creation of DApps is no longer a herculean odyssey but an accessible endeavor.

DeFi in simple word

Embarking on the odyssey of unraveling the intricacies of DeFi requires navigation through a landscape where it transcends the ephemeral veil of conceptual novelty, metamorphosing into a palpable and executable reality. DeFi encapsulates a trove of digital assets, protocols, smart contracts, and decentralized applications that find their dwelling within the expansive confines of the blockchain. The nimbleness and expeditious evolution of the Ethereum digital currency network render it the vanguard for DeFi implementation, though not an exclusive option. Across the spectrum, decentralized financial projects have found sanctuary on the TRON network, instilling optimism among users who, in turn, allocate a fraction of their capital to TRON, discerning latent potential in its nascent future.

Envision a utopian financial ecosystem—an oasis where the cultivation of intricately detailed financial tools and services unfurls in a tapestry of decentralization on the blockchain. The orchestration of these services becomes an effortless ballet, thanks to the symphony conducted by blockchain technology, harmonizing the seamless integration, modification, and amalgamation of financial structures. As an illustrative tableau, the Ethereum blockchain unveils captivating programs—a decentralized banking system, a decentralized payment system, and a decentralized lending system—each contributing to the symphonic complexity that defines DeFi.

DeFi and CeFi

As the narrative meanders through the corridors of disparity, the demarcation between DeFi and CeFi (Traditional Financial Services) materializes. The exposition above hints at a dilapidated architectural draft for the future of the financial industry. The subtle inception of DeFi, though on a modest scale, predates the current zeitgeist. In the present milieu, a myriad of decentralized applications in DeFi beckons, offering a tantalizing prospect for circumventing conventional financial avenues. Contemplate lending and accruing interest in the realm of cryptocurrencies or procuring a loan to inaugurate a personal enterprise. The expansive universe of DeFi expands its frontiers with celerity.

The path forward is long and winding, with the nascent stages of exploration still unfolding. The lack of a singular corporate or organizational vanguard to propel DeFi into the future is a contributing factor. Across continents, the relentless dedication of individuals, teams, and groups to the development of DeFi persists, unfolding in a decentralized ballet of activities. Within this labyrinth, a myriad of divergent interests and approaches coalesce, begetting achievements and, inevitably, challenges.

A concerted endeavor emerges, striving to draw a demarcation between DeFi DApps and the bastions of traditional centralized banks. In the ensuing exploration of the quintessential distinctions between decentralized applications and the prevailing citadels of Centralized Finance (CeFi), a panorama of significant disparities unfurls. Noteworthy in this narrative is the emergence of hybrid platforms, embryonic in their development, seamlessly intertwining the elements of DeFi and CeFi to herald a paradigm entirely distinct from the established order.

Operational Autonomy of Decentralized Applications (DApps) within DeFi Paradigm

In the conventional paradigm, the mantle of operational responsibility drapes the shoulders of venerable financial institutions and banks. DeFi, however, has orchestrated a paradigm shift, supplanting these venerable entities with meticulously predefined rules encapsulated within the intricate folds of smart contracts. These decentralized applications deftly harness the prowess of smart contracts, orchestrating an autonomous symphony of transactional control that ostensibly obviates the exigency for manual intervention. Nevertheless, the tapestry of human involvement remains an indispensable thread, intricately woven into the fabric for the resolution of bugs, the augmentation of performance, and the overarching refinement of this enigmatic orchestration.

The best cryptocurrencies with low prices to begin

Holistic Luminescence of Network Operations

A glaring critique aimed at the conventional financial edifice revolves around its impenetrable opaqueness, an opacity shrouding the entire ecosystem and rendering its flow impervious to prying eyes. In stark contradistinction, DeFi unfolds a divergent narrative; its source code unfurls itself, an open manuscript inviting the gaze and participation of the discerning observer. This transparency, heralded as a linchpin within the DeFi ethos, emanates from the demarcated nature of smart contracts, an integral cornerstone of the enigmatic DeFi tableau.

Amidst debates where some posit that the unfettered visibility of transactions compromises individual sanctums, the annals of DeFi bear witness to the ubiquitous deployment of aliases—a clandestine lexicon endemic to the broader cryptocurrency milieu. While the assets domiciled within a cryptocurrency wallet, nestled within the bosom of a public blockchain, are laid bare for all to behold, the visage of the proprietor remains ensconced in a cloak of anonymity, preserving a veneer of pseudonymity.

What is a consortium blockchain?

Ubiquitous Access to DApps: A Global Affair

DeFi unfolds its tapestry uniformly, an ethereal entity transcending geographical confines, extending its global tendrils to anyone tethered to the digital realm. Temporal boundaries dissipate, for decentralized applications and their smart contract counterparts stand as perpetual sentinels, vigilant around the temporal clock. Though the conditions may hinge on the particularities of the smart contract du jour, the overarching modus operandi remains tethered to this immutable principle.

A resounding dissonance emerges when juxtaposing this unrestrained access against the constrained environs encountered when traversing the labyrinthine corridors of traditional banking institutions—particularly poignant for denizens residing within territories like Iran, ensnared by sanctions, bereft of access to an array of international services.

Access DApps anytime from anywhere

Underestimating the significance of the “permissionless” hallmark would be a folly of considerable magnitude. This stands tall as one of the preeminent facets in the DeFi kaleidoscope. The very fabric of DeFi’s permissionless tapestry extends an open invitation, beckoning anyone armed with internet connectivity to partake in its enigmatic ballet, sidestepping the need for bespoke licenses or labyrinthine registration processes. In the realm of DeFi, where smart contracts reign supreme, their idiosyncratic nature and omnipotence cast them as the sole arbiters, with DeFi’s compass calibrated by the conditions and regulations imprinted upon these very smart contracts.

The Atomization of Transactions

In the annals of blockchain immortality, when a transaction etches itself onto the ledger, a sequence of automatons stirs into action—perhaps a medley of multifarious financial transactions cascading in chronological orchestration. In the DeFi realm, these transactional sets embark upon an atomic ballet. The dance of atomicity dictates a binary denouement: the triumphant completion of all stages or the unceremonious cancellation of the entire ensemble. Within the precincts of traditional financial obelisks, such structural congruence demands a sacrificial offering—exorbitant costs and the protracted pilgrimage through the corridors of legal approbation.

Public Adjudication of Transactions: A Ritual of Transparency

Service purveyors within the decentralized financial echelon may not universally unveil the mantle of open-source garb, yet within the blockchain tapestry, they stand before the court of public adjudication. This avowal underscores the non-custodial tenor of DeFi. In contradistinction to the traditional financial amphitheater, where the stages of transactions shroud themselves in secrecy, DeFi unfurls its stages for the gaze and confirmation of the user cohort. This transparency, a cardinal advantage enshrined in the DeFi doctrine, fertilizes the soil of trust and confidence, nurturing an ecosystem where the denizens repose faith in the transparency that is their due.

The possibility of developing and expanding software anonymously

Within the precincts of centralized financial fiefs, the fortress of privacy is feeble, its ramparts providing but scant cover for the orchestration of anonymous transactions. In the realm of DeFi, a tapestry of active projects is woven by the deft hands of anonymous architects, orchestrators shrouded in veils of ambiguity. Even in the contemporary saga, the enigma surrounding the progenitor of Bitcoin persists—a testament to the cryptic nature of the crypto realm. Post-installation, miners play the puppeteer to smart contracts on DeFi platforms, their manipulation transpiring in the shadows, devoid of direct entanglement with users. Anonymous financial DeFi applications, crafted to engage directly with smart contracts, eschew the need for user interposition—a symphony composed in the silence of covert participation.

Absolute Custodianship

The dichotomy between the DeFi dominion and the traditional financial fiefdom is illuminated by the sovereign control vested in individuals within the former. Yet, this dominion, a throne of power and unbridled control, is not unaccompanied by the attendant duties. DeFi’s architectural blueprint bequeaths unto users the stewardship of shouldering the onus of all technical and systemic risks endemic to the platform. This mantle of responsibility, accompanied by a palpable sense of risk, has steered a cohort of digital asset acolytes towards decentralized exchanges—a realm dramatically divergent from the citadels of centralized financial orthodoxy.

Cryptocurrencies Trading

Navigating the intricate landscape of digital currency transactions unveils a juxtaposition between centralized exchanges (CEX) and their decentralized counterparts (DEX). The former, akin to the established edifices of traditional financial systems, meticulously inscribe the annals of order history of the blockchain. In stark contrast, the latter, the decentralized bastions of innovation, chart an entirely distinct trajectory. These exchanges, in their avant-garde approach, exercise dominion over user orders through the orchestration of automated market maker (AMM) protocols. Within this decentralized milieu, the ethereal dance of price determination ensues, choreographed by a symphony of algorithms and the undulating tides of transaction volumes.

Transactions Fee

Delving into the realm of transactional economics within the DeFi echelon, the imposition of fees assumes an indispensable role. The bedrock of decentralized financial systems necessitates the levying of charges, a deterrent against the nefarious currents of money laundering. A paradox emerges as certain centralized financial entities, in adherence to anti-money laundering regulations, extend certain services altruistically, proffering a semblance of respite amid the labyrinth of transactions.

Crypocurrency and Taxes; What you need to know

Privacy

The elusive tapestry of privacy unfurls as DeFi projects, like phantoms traversing the digital expanse, find their home on selective blockchains. The clandestine nature of transactions, however, is but a mirage, as these cryptographic interactions bear witness to the watchful gaze of selected ledgers. In stark contradistinction, the centralized exchanges, cloaked in the mantle of anti-money laundering laws, wield the authority to unveil the entirety of user information before the hallowed tribunals of legal scrutiny.

Bridges

In the intricate ballet of interoperability, popular cryptocurrencies, exemplified by the titan Bitcoin, oscillate between hands-on diverse blockchain-based financial stages. The DeFi platforms, however, with their esoteric intricacies and labyrinthine transactional registration, often exclude these digital titans from their repertoire. Yet, the centralized financial services, akin to alchemists transmuting base metals into gold, deftly navigate these complexities through the adept utilization of interoperable services and judicious capital reserves across a multitude of chains. The multiverse of popular digital assets, scattered across disparate blockchains, engages in a soliloquy of non-interaction, as the centralized financial systems, with their supportive bastion of interoperable services, reign supreme.

Advantages and features of DeFi

The pivotal juncture of fiat currency exchange, a terrain where centralized financial systems reign supreme, unfolds as a saga of converting tangible currencies into their intangible counterparts and vice versa. The decentralized realm of DeFi, despite its ethereal structure, beckons individuals towards the gateway of organizational entities for the alchemical conversion of fiat currency into the elusive nectar of their desired cryptocurrencies. A saga unfolds wherein organizations, akin to sylvan guardians, strive to furnish services of a caliber that not only satiate but elevate the experiential landscape of their patrons.

Embarking on an odyssey through the pantheon of DeFi’s advantages and features, the incontrovertible need for centralized entities in the time-honored tapestry of traditional financial systems stands juxtaposed against the decentralized sanctums of DeFi. These digital enclaves, forged in the crucible of code, emerge as arbiters in the resolution of disputes, wielding the power to bestow upon users the mantle of absolute dominion over their financial fiefdoms. The consequence of this paradigm shift is the seismic reduction in the Byzantine tolls and tributes exacted by the traditional financial gatekeepers, heralding the dawn of a frictionless financial utopia.

The ensuing discourse unfurls the tapestry of blockchain’s benedictions upon DeFi. A decentralized financial system, the phoenix rising from the blockchain’s ashes, eviscerates the specter of security vulnerabilities. Every nuance of this ecosystem etches its indelible imprint on the blockchain, a testament to the immutable ledger embraced by thousands of nodes in a synchronized dance. Censorship and illicit tampering, erstwhile harbingers of turmoil, wither into oblivion, extinguishing the very specter of service termination.

Decentralization is the most important feature of DeFi

The saga continues with the chorus of the open and unshackled DeFi, resonating with the cadence of ease for those fettered by the constraints of conventional banking systems. A novel panacea emerges, extending its balm to those relegated to the fringes by sanctions or restrictions, offering a lifeline where access was once barred. The traditional financial citadels, tethered to intermediaries reaping the dividends of their machinations, stand aloof from low-income realms, leaving a void that DeFi, as articulated earlier, rushes in to fill. Costs recede like the tides, and financial and monetary services extend their embrace to a broader spectrum of individuals, culminating in a symphony orchestrated by the diminution of intermediaries.

Transparency

The magnum opus of DeFi is encapsulated in its embodiment of decentralization. A phalanx of computers, an electronic legion sustaining the network, bequeaths unparalleled fortitude, obliterating the specter of a singular point of failure akin to the monolithic central banking institutions. These nodes, disparate yet harmonious participants in the network’s grand tapestry, collaborate to shepherd transactions through the digital agora. In this choral convergence, the specter of surreptitious dealings, concealed from the public gaze, dissipates into the ephemeral winds, leaving an indelible imprint of transparency on the annals of the decentralized financial odyssey. The most profound revelation lies in the fact that, whether for benevolence or malevolence, no singular entity can manipulate the system clandestinely, for the decentralized eyes of the public bear witness to every digital flux and reflux.

The world of DeFi is anti-censorship

“The realm of decentralized financial operations stands as an impregnable fortress against the onslaught of censorship, offering any individual, compliant with established protocol laws, the opportunity to partake in transactions within the intricacies of the network. Post each transactional endeavor, a quasi-sacrosanct memorialization occurs within the annals of the blockchain, endowing it with indomitable immutability. This unequivocally implies an insurmountable barrier against any abuse of authority or malicious system intrusions, precluding the expunction of fund transfers from one account to another (in the parlance of addresses), or the veiling of nefarious activities. This unique attribute owes its existence to the immutable nature inherent in the blockchain.

Conversely, global powers, with the United States prominently situated, find themselves bereft of the coercive prowess necessary to dictate the cessation of services by a financial system akin to a conventional bank to users in a designated region or country. This quandary currently manifests itself in the interactions of international banks with Iranian entities. The decentralized nature of the infrastructures instrumental in the evolution of DeFi protocols and applications is the crux of this resilience.

DeFi is fast

DeFi epitomizes celerity, an unprecedented velocity injected into the financial ecosystem by the advent of DeFi and blockchain-based solutions. This momentum is the impetus behind the integration of DeFi practices by contemporary financial institutions, exemplified by EQIFi’s zealous pursuit to ascend to the zenith as the premier leader in the DeFi industry.

Certainly, the paramount objective of diverse DeFi payment protocols lies in furnishing instantaneous and economically viable transactions for denizens of the digital currency realm. This is notwithstanding the temporal efficacy of DeFi lending platforms and ancillary services, contingent upon the velocity of the networks they inhabit, influenced by considerations such as scalability and interoperability. Ethereum, a pivotal host for numerous DeFi platforms, grapples with pronounced scalability deficiencies and exorbitant transactional costs.

It is imperative to acknowledge that the concept of speed pertains to the internal transaction processing time within the system. Ponder upon a commonplace scenario: a user residing in a non-sanctioned jurisdiction endeavor to transmit funds through traditional banking channels to another party. This conventional process spans a duration of 24 to 72 hours. This temporal investment is further exacerbated for residents of sanctioned territories, with commensurate escalations in associated fees.

This laboriousness is amplified when one ventures beyond mere fund transfers to engage in other financial services, such as obtaining loans. Traditional banks habitually exhibit reluctance to accede even to a lone or dual guarantor, introducing formidable impediments for clientele. DeFi, in stark contrast, proffers facile utilization of cryptocurrency assets as collateral for loan acquisition. This undertaking, however, necessitates a judicious acknowledgment of associated risks stemming from volatile market fluctuations, mitigable through adept risk management and capital deployment.

DeFi can be programmed and automated

DeFi is characterized by programmability and automation, underpinned by the pervasive integration of smart contracts within its protocols and applications. These intelligent contracts facilitate the scheduling and comprehensive automation of myriad operations. This not only expedites decentralized financial processes but concurrently diminishes the incidence of human errors to a statistically negligible degree.

A smart contract is a sophisticated program that, upon the fulfillment of a predetermined set of conditions, undergoes automatic execution of a sequence of actions. Envisage a scenario within the domain of a lending platform: upon the transmission of one of three digital currencies – Bitcoin, Ethereum, or Cardano – to the designated smart address of the contract, a Stablecoin equivalent to 70% of the deposited asset is instantaneously dispatched to the sender. This elucidates the automaticity inherent in the operation, epitomizing the reduction of manual oversight and approval prerequisites by an operator within the DeFi landscape.

Elevating productivity through intelligent automation within decentralized financial processes constitutes one of DeFi’s loftiest aspirations. Within DeFi’s purview, the conventional trappings of offices, personnel, managerial hierarchies, and cumbersome administrative protocols are rendered obsolete; the corporeal imprints of physical document signatures are supplanted by the ethereal efficiency of computer code. Unlike their human counterparts, these codes exhibit the capacity to respond seamlessly to the exigencies of thousands of users in real time, 24 hours a day.”

What is DEX and how it works?

Decentralized exchanges, or DEXs, are peer-to-peer markets where cryptocurrency investors may conduct operations without entrusting their assets to an intermediate or administrator. These interactions are enabled by the use of smart agreements, which are automatic contracts constructed using code.

DEXs were designed to eliminate the need for any governing body to supervise and sanction deals conducted within a given exchange. Decentralized exchanges enable peer-to-peer (P2P) cryptocurrency trading. A peer-to-peer marketplace connects consumers and sellers of cryptocurrency. They are often non-custodial, which implies that users retain ownership of their wallet’s private keys.

A private key is a sophisticated way of encrypting that allows users to retrieve their currency. After logging into the DEX using their private key, users may instantly view their crypto accounts. They will not be forced to enter any private data, such as addresses or names, which is ideal for those who value confidentiality.

Computerized market makers, for example, helped draw consumers to the decentralized finance, or DeFi, area and assisted significantly in its development. DEX organizers and wallet plugins fostered the rise of decentralized exchanges by reducing token prices, exchange fees, and movement, while also providing consumers with a better rate.

Cryptocurrency exchanges are an important source of stability for the worldwide crypto marketplace, supporting millions of dollars in daily trade activity. Prominent exchange systems keep expanding in accordance with the increasing need for digital assets, delivering asset custody, additional trading capabilities and features, as well as access to an expanding variety of digital assets as the market develops.

Order Book

Decentralized crypto exchanges and DeFi devices have several iterations. The initial generation of decentralized trading platforms, like traditional exchanges that are centralized, employ order books. These order books are used to keep track of all outstanding purchase and sell transactions for a certain commodity. The disparity between these rates affects the order book breadth and the current market price. This data is frequently maintained on-chain during transactions on DEXs with order books, while your money stays outside of the chain in your wallet. Most DEXs specialize in a certain financial product that is performed decentralized.

However, DEX systems that keep their order books outside the blockchain simply execute deals on the network so as to provide dealers with the advantages of centralized exchanges. Off-chain order books assist exchanges in saving money and speeding up while helping to ensure that deals are performed at the prices preferred by users.

The exchanges additionally enable users to make loans of their cash to other traders in order to provide stretched trading possibilities. Borrowed money accumulates interest and is guaranteed by the exchange’s liquidation system, which ensures borrowers are paid even if dealers fail to fulfill their bets.

Below, some examples are mentioned:

• dYdX

• Nash Exchange

• Tomo DEX

• ViteX

• DDEX

• Binance DEX

• Loopring Exchange

Swaps

Order books are no longer used to conduct transactions or determine prices on the upcoming wave of exchanges that are decentralized. To calculate commodity prices, such platforms often use stability pool methods. These peer-to-peer trading platforms instantaneously conduct deals between users’ wallets – an action known as a swap by some. The total amount locked (TVL), or the value of assets held in the protocol’s smart contract, is used to rank the DEXs in this area. Such as:

• Uniswap

• Curve

• SushiSwap

• Gnosis

• Balancer

• Bancor

• Kyber

• DODO

Benefits Of Using A DEX:

• Token accessibility

• Privacy

• Security threats have been reduced.

• Decreased counterparty risk

Drawbacks Of Using A DEX:

• It is necessary to have certain expertise.

• Risks associated with smart contracts

• Token postings that have not been vetted

• Decentralized exchanges are constantly changing

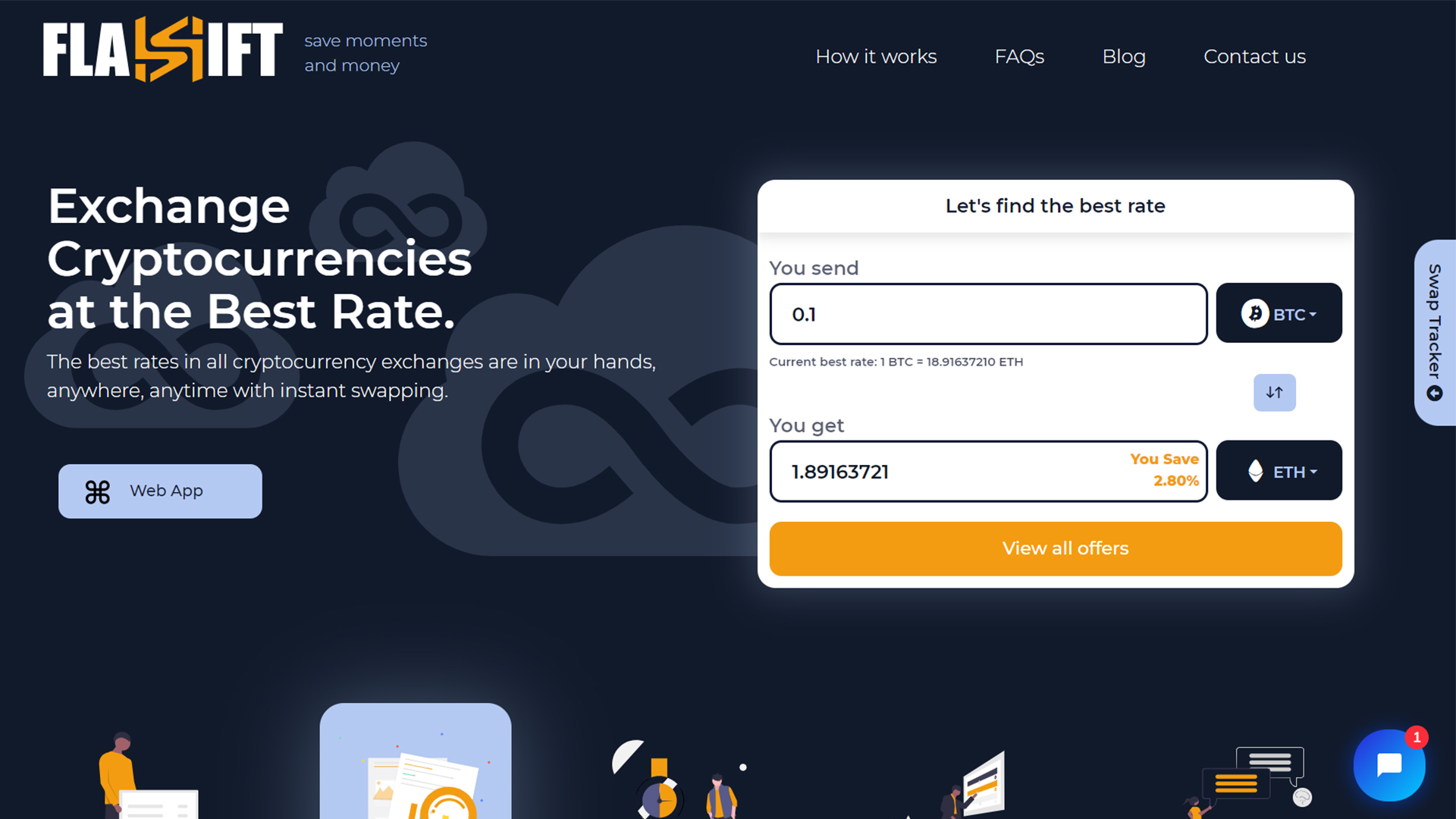

What’s the benefit of using the Flashift?

Decentralized exchanges only have the ability to swap in the tokens of their activity network. For example, UniSwap is only able to swap ERC-20 tokens on the Ethereum platform. But Flashift offers another solution with its unique feature. With the Flashift.app, you can convert tokens of different blockchains to each other.

Flashift is very easy to use and does not require authentication and a wallet connection. Just enter the token amount you want to convert and after confirming the transaction, the token conversion will be done automatically and deposited into your wallet.

References: